Automotive accident demand letter to insurance coverage firm, a vital step in searching for justice and compensation after a collision, calls for a meticulous method. This letter serves as a proper notification to the insurance coverage firm, outlining the damages incurred and demanding a good settlement. Understanding the nuances of this course of is paramount for navigating the complexities of insurance coverage claims, making certain your rights are protected and your wants are met.

Put together your self to navigate the intricacies of this vital doc, a cornerstone in securing honest compensation.

This information delves into the important elements of crafting a compelling demand letter, exploring authorized concerns, communication methods, negotiation techniques, and potential outcomes. From understanding the construction and elements of a powerful demand letter to evaluating damages and supporting proof, this complete overview equips you with the data to successfully pursue your declare.

Introduction to Demand Letters

A requirement letter, within the context of a automobile accident, is a vital instrument within the pursuit of justice and honest compensation. It serves as a proper notification to the insurance coverage firm, outlining the damages sustained and the corresponding monetary restitution sought. This structured communication acts as a precursor to potential authorized motion, aiming to resolve the matter amicably and effectively.

It is a beacon of readability, illuminating the trail towards decision, grounded in reality and equity.The construction of a powerful demand letter is fastidiously designed to obviously articulate the claimant’s place. This meticulous method emphasizes the significance of factual accuracy and authorized soundness, making certain the letter’s effectiveness. It units the stage for a easy negotiation, and in the end, a swift decision.

A well-crafted demand letter instills confidence within the claimant’s resolve and the validity of their declare.

Objective and Construction of a Demand Letter

A requirement letter’s major goal is to formally demand compensation for damages arising from a automobile accident. Its construction is meticulously crafted to current the declare persuasively and compellingly. The letter clearly lays out the details of the accident, the accidents sustained, and the monetary losses incurred.

Key Parts of a Robust Demand Letter

A sturdy demand letter contains a number of important elements, every taking part in an important position in its effectiveness. These elements are designed to make sure the insurance coverage firm understands the claimant’s place totally.

- Identification of Events: Clearly identifies the events concerned, together with the injured celebration, the at-fault driver, and the insurance coverage firm. This part ensures readability and avoids ambiguity.

- Detailed Account of the Accident: Gives a complete and correct account of the accident, together with the date, time, location, and contributing elements. This meticulously documented account serves as a factual foundation for the declare.

- Description of Accidents: Detailed documentation of accidents sustained, together with medical data, diagnoses, therapy plans, and restoration timelines. This part supplies irrefutable proof of the bodily and emotional affect of the accident.

- Documentation of Damages: Consists of all monetary losses ensuing from the accident, corresponding to medical bills, misplaced wages, property harm, and ache and struggling. This complete accounting supplies a whole image of the financial penalties.

- Authorized Foundation for Declare: Clearly states the authorized grounds for the declare, referencing relevant legal guidelines and rules. This part ensures the declare is legally sound.

- Demand for Compensation: States the particular quantity of compensation sought, itemizing the prices related to medical bills, misplaced wages, property harm, ache and struggling, and different related elements. This can be a pivotal a part of the letter, demanding acceptable monetary restitution.

- Proposed Settlement Settlement: Artikels a proposed settlement settlement. This ingredient serves as a possible path towards amicable decision, avoiding the complexities of litigation.

- Contact Info: Gives contact data for each events, making certain clear strains of communication. This part facilitates seamless communication and negotiation.

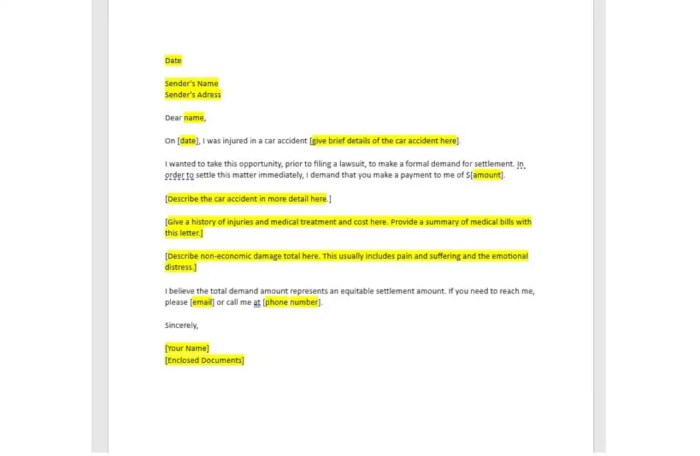

Pattern Format for a Demand Letter

A pattern format for a requirement letter might be offered in a transparent and structured method.

Pattern Format:[Your Name and Address][Date][Insurance Company Name and Address]Topic: Demand Letter for Damages Arising from Automotive Accident on [Date of Accident] at [Location of Accident][Detailed Account of Accident][Description of Injuries][Documentation of Damages][Legal Basis for Claim][Demand for Compensation][Proposed Settlement Agreement][Contact Information]

Sections of a Demand Letter and their Objective

The next desk Artikels the completely different sections of a requirement letter and their particular goal.

| Part | Objective |

|---|---|

| Identification of Events | Establishes the events concerned within the declare. |

| Detailed Account of the Accident | Gives a factual account of the accident. |

| Description of Accidents | Paperwork the accidents sustained. |

| Documentation of Damages | Particulars all monetary losses incurred. |

| Authorized Foundation for Declare | Artikels the authorized grounds for the declare. |

| Demand for Compensation | Specifies the quantity of compensation sought. |

| Proposed Settlement Settlement | Suggests a possible decision. |

| Contact Info | Gives communication channels. |

Authorized Issues in Demand Letters

A requirement letter, a vital instrument within the pursuit of justice, acts as a proper notification of a declare, laying the groundwork for a possible authorized motion. It articulates the injured celebration’s rights and asserts the duty of the accountable celebration within the unlucky circumstances of an accident. Understanding the authorized ideas underpinning such a letter is important for a strong and efficient declare.The authorized framework of a requirement letter is rooted in ideas of civil legal responsibility, specializing in the idea of negligence.

This includes establishing that the accountable celebration didn’t act with the extent of care an inexpensive individual would have exercised in related circumstances, leading to hurt to a different. This failure is essential in establishing the required basis for a declare.

Negligence and Legal responsibility

Negligence, a cornerstone of non-public harm claims, encompasses the failure to train cheap care. This could manifest in numerous varieties, corresponding to violating site visitors legal guidelines, failing to take care of a protected surroundings, or participating in reckless conduct. Establishing legal responsibility hinges on demonstrating a causal connection between the negligent act and the ensuing hurt. As an example, if a driver runs a crimson mild and collides with one other automobile, demonstrating the driving force’s violation of the site visitors legislation and the following accident establishes a transparent hyperlink between negligence and hurt.

Damages

Damages, the compensation looked for accidents sustained, type an important part of a requirement letter. They embody numerous kinds of losses, together with financial and non-economic damages. The quantification of damages is a vital facet, requiring meticulous documentation and proof.

Kinds of Damages

- Medical Bills: These characterize the prices related to therapy, together with physician visits, hospital stays, and bodily remedy. Correct data and receipts are paramount in supporting these claims. For instance, a sufferer’s medical payments totaling $10,000 are instantly verifiable as proof of monetary loss.

- Misplaced Wages: This class encompasses the earnings misplaced because of the lack of ability to work due to accidents. Documentation corresponding to pay stubs and employment verification letters are important for calculating misplaced wages. A employee who misses two months of labor on account of accidents will incur misplaced wages that want cautious calculation.

- Ache and Struggling: This encompasses the bodily and emotional misery attributable to the accident. Whereas tough to quantify exactly, ache and struggling are sometimes calculated primarily based on the severity of accidents, the length of restoration, and the affect on the sufferer’s high quality of life. As an example, a sufferer struggling continual ache would possibly obtain compensation for the extended emotional misery and bodily discomfort related to their accidents.

Proof, Automotive accident demand letter to insurance coverage firm

Proof performs a vital position in substantiating the claims Artikeld in a requirement letter. This contains images, medical data, witness statements, police studies, and accident reconstruction studies. Complete and correct proof is important for establishing the reality of the occasions and supporting the declare for damages. The power of a declare is instantly proportional to the standard and amount of the supporting proof.

| Kind of Harm | Description | Instance Calculation |

|---|---|---|

| Medical Bills | Prices related to therapy. | $5,000 (physician visits) + $2,000 (hospital keep) = $7,000 |

| Misplaced Wages | Earnings misplaced on account of lack of ability to work. | $1,000/week – 4 weeks = $4,000 |

| Ache and Struggling | Bodily and emotional misery. | Primarily based on severity of accidents, restoration time, and affect on high quality of life. Usually decided by knowledgeable testimony or a pre-determined system. |

Speaking with the Insurance coverage Firm

A requirement letter, a beacon of righteous recourse, requires a exact and respectful communication technique with the insurance coverage firm. This course of, akin to a religious pilgrimage, calls for readability and unwavering resolve to realize the specified final result. The journey necessitates understanding the nuances of supply strategies and the refined artwork of communication.Efficient communication is paramount in attaining a positive decision.

The insurance coverage firm, a posh entity, usually operates underneath a framework of established procedures. Understanding these procedures, and aligning our method with them, will result in a extra harmonious and in the end profitable interplay.

Supply Strategies for Demand Letters

The selection of supply methodology for a requirement letter is akin to choosing essentially the most potent instrument for a particular religious observe. Every methodology carries distinctive implications and potential outcomes.

- Licensed Mail: This methodology, with its official file, is sort of a formal affirmation of your intentions. It supplies proof of supply, a tangible testomony to your dedication.

- Registered Mail: A carefully associated possibility, registered mail additionally gives a file of supply. It’s usually most popular in situations the place monitoring the letter is vital.

- E-mail: This contemporary method, whereas handy, ought to be used with warning. E-mail correspondence, although readily accessible, lacks the formal weight of licensed or registered mail. It is appropriate for preliminary contact or follow-up communications, however not for the first supply of the demand letter.

- Fax: Faxing, although faster than different strategies, could also be much less dependable. The potential for misinterpretation or technical points warrants cautious consideration.

Communication Etiquette with Insurance coverage Adjusters

Sustaining respectful {and professional} communication with insurance coverage adjusters is essential. That is analogous to participating in a sacred dialogue, searching for understanding and a good decision.

- Professionalism: Sustaining knowledgeable demeanor, even throughout tense moments, is significant. Keep away from inflammatory language, and as an alternative concentrate on clear, concise communication.

- Clear and Concise Language: Use language that’s simply understood. Keep away from jargon or technical phrases that the adjuster might not grasp. Readability is vital to avoiding misunderstandings.

- Energetic Listening: Actively take heed to the adjuster’s responses and acknowledge their considerations. This empathetic method can foster mutual understanding.

- Documentation: Preserve meticulous data of all communications, together with dates, instances, and contents. This complete file is important for future reference.

Strategies for Sending Demand Letters

This desk Artikels numerous strategies for delivering a requirement letter, every with its personal set of benefits and drawbacks.

| Methodology | Description | Benefits | Disadvantages |

|---|---|---|---|

| Licensed Mail | Gives proof of supply | Excessive degree of authorized safety | Could also be slower than different strategies |

| Registered Mail | Gives proof of supply | Good steadiness between safety and pace | Will not be as readily accessible as licensed mail |

| Handy and quick | Straightforward to trace preliminary contact | Lacks formal weight for essential paperwork | |

| Fax | Quick supply | Handy for fast responses | Lacks formal weight; susceptible to errors |

Efficient Communication Methods

Efficient communication with insurance coverage adjusters requires a strategic method.

- Pre-emptive Methods: Proactive communication, like outlining the particular particulars of the accident, and the following damages, is vital to making sure a smoother course of. This preemptive method can anticipate potential challenges.

- Comply with-up Methods: Common follow-up communication, whether or not through e mail or cellphone, is significant. This demonstrates dedication to the case and ensures that the adjuster stays engaged.

- Addressing Obstacles: Anticipate potential obstacles, corresponding to differing interpretations of the accident. Having pre-prepared responses, or a clearly Artikeld demand letter, might help alleviate these considerations.

Potential Obstacles and Overcoming Them

Potential obstacles in speaking with insurance coverage corporations might be overcome with a well-defined technique.

- Insurance coverage Firm’s Procedures: Understanding the corporate’s established procedures is essential. This enables us to navigate the system effectively and keep away from pointless delays.

- Adjuster’s Response: The adjuster’s response might not all the time be favorable. A well-structured demand letter, mixed with skilled communication, might help to deal with considerations and attain a decision.

- Communication Limitations: Cultural or linguistic variations can create boundaries. Utilizing clear and concise language, and searching for clarification when wanted, might help to beat these obstacles.

Negotiating with the Insurance coverage Firm

The trail to decision in a automobile accident declare usually includes navigating the labyrinthine corridors of negotiation. This course of, although doubtlessly difficult, might be approached with a transparent understanding of the ideas concerned and the methods that result in favorable outcomes. A harmonious negotiation fosters a way of shared duty and a collective need to realize a simply and equitable settlement.Efficient negotiation just isn’t merely a transactional course of; it’s a dance of understanding and compromise.

It requires a profound respect for the opposing celebration’s perspective and a dedication to discovering widespread floor. By using strategic approaches and sustaining steadfast concentrate on the core ideas of the case, a passable decision might be achieved, restoring a way of steadiness and equilibrium.

Widespread Negotiation Ways

Negotiation techniques in insurance coverage claims usually contain a mix of assertive and collaborative methods. Understanding these approaches permits one to have interaction within the course of with a heightened consciousness of potential outcomes. The purpose just isn’t merely to win however to discover a decision that satisfies all events concerned.

- Asserting Your Place: This includes clearly outlining the calls for and the justification behind them. The power of your case, coupled with well-documented proof, can present a powerful basis for negotiation. This method includes presenting your place with confidence and readability, however all the time remembering that compromise is vital.

- In search of Widespread Floor: This includes figuring out shared pursuits and discovering mutually useful options. Concentrate on areas the place the insurance coverage firm is perhaps keen to concede, recognizing that also they are aiming for a decision that minimizes their monetary publicity.

- Constructing Rapport: Establishing a respectful {and professional} relationship with the insurance coverage adjuster fosters belief and creates an surroundings conducive to productive discussions. This includes clear communication, lively listening, and a collaborative method.

Methods for Efficient Negotiation

Efficient negotiation includes meticulous planning, cautious communication, and a powerful understanding of the authorized ideas concerned. It’s important to be well-prepared, each emotionally and strategically.

- Complete Documentation: Sustaining detailed data of all communication, medical payments, misplaced wages, and different related bills is paramount. This meticulous documentation serves as a strong software throughout negotiations, offering concrete proof to assist your claims. This isn’t merely a guidelines; it is a testomony to the validity of your case.

- Skilled Session: Partaking with authorized counsel can present invaluable steering on the specifics of the declare and negotiation methods. This collaboration ensures that your pursuits are represented successfully and strategically all through the negotiation course of.

- Understanding Insurance coverage Firm Insurance policies: Familiarity with the insurance coverage firm’s declare settlement procedures and insurance policies might help anticipate their potential responses and develop methods which are extra more likely to be accepted. This understanding just isn’t about outsmarting the corporate, however about working inside their framework to search out widespread floor.

Comparative Evaluation of Negotiation Approaches

Completely different negotiation approaches have various levels of success, relying on the particular circumstances.

| Negotiation Strategy | Description | Potential Strengths | Potential Weaknesses |

|---|---|---|---|

| Positional Bargaining | Focuses on firmly asserting your calls for. | Will be efficient if the opposite celebration is keen to concede. | Can result in impasse if each events are rigid. |

| Principled Negotiation | Focuses on shared pursuits and discovering mutually useful options. | Results in extra sustainable agreements. | Will be time-consuming. |

| Collaborative Negotiation | Entails lively listening and searching for artistic options. | Builds rapport and belief. | Will not be appropriate if the opposite celebration just isn’t keen to collaborate. |

Examples of Profitable Negotiation Methods

Quite a few profitable negotiation methods have been employed in related circumstances, usually specializing in constructing rapport and presenting compelling proof. Examples vary from settling a declare via a good compensation package deal to attaining a whole payout primarily based on the severity of the accidents.

- Case Research 1: In a case the place a driver was discovered to be at fault, a well-documented declare with clear proof of medical bills and misplaced wages led to a big settlement that lined the total quantity of damages.

- Case Research 2: A meticulous method to documentation and knowledgeable session allowed a consumer to safe a good settlement that adequately addressed each the bodily and emotional trauma skilled within the accident.

Significance of Documentation in Negotiation

Thorough documentation is the bedrock of a profitable negotiation. It supplies irrefutable proof supporting your claims, growing your leverage in negotiations.

- Important for Proof: Properly-organized data of medical payments, restore prices, and witness statements are essential for demonstrating the validity and extent of the damages.

- Safety In opposition to Disputes: Detailed data assist stop misunderstandings and disputes later within the course of. It supplies a transparent and complete file of the whole negotiation course of.

Potential Outcomes and Subsequent Steps

Embarking on the trail of authorized recourse requires a eager understanding of the potential outcomes. The universe of potentialities unfolds earlier than us, demanding a transparent imaginative and prescient and resolute motion. Navigating this course of with knowledge and readability is paramount. The demand letter serves as a pivotal second, a catalyst for both amicable decision or the graduation of a extra formal authorized engagement.

Attainable Outcomes of Sending a Demand Letter

The cosmos of outcomes extends past the quick response of the insurance coverage firm. A profitable demand letter can result in swift and favorable settlement, aligning with the cosmic concord we search. Alternatively, the insurance coverage firm would possibly supply a counter-proposal, prompting a negotiation that requires astute discernment and strategic maneuvering. This stage underscores the significance of authorized counsel.

In the end, the demand letter could also be deemed inadequate, necessitating additional motion.

Subsequent Steps If the Insurance coverage Firm Rejects the Demand

If the insurance coverage firm rejects the demand, the trail ahead necessitates a meticulous evaluation of the state of affairs. Additional investigation and authorized session are essential to guage the power of the case. The choice to pursue additional authorized motion hinges on a cautious analysis of the proof, the projected prices, and the potential return. This stage underscores the significance of strategic planning.

Examples The place a Demand Letter Would possibly Not Be Enough

There are circumstances the place a requirement letter is probably not ample to realize the specified final result. This usually arises when the insurance coverage firm demonstrates a transparent refusal to have interaction in good religion negotiations or when the declare includes complicated authorized points past the scope of a easy demand letter. Moreover, situations of egregious negligence or intentional misconduct necessitate a extra formal method.

The Strategy of Submitting a Lawsuit

Initiating a lawsuit requires a proper criticism outlining the grounds for the declare. The criticism particulars the alleged wrongdoing, supporting proof, and the sought-after treatment. The method usually includes a sequence of procedural steps, together with submitting the criticism, service of course of, and the chance for responses from the opposing celebration. The authorized course of might be intricate and time-consuming.

A Desk Illustrating Outcomes

A transparent understanding of the potential outcomes permits for efficient strategic planning. This desk summarizes doable outcomes and corresponding subsequent steps:

| End result | Subsequent Steps |

|---|---|

| Insurance coverage Firm Accepts Demand | Settlement is finalized in response to agreed phrases. |

| Insurance coverage Firm Presents Counter-Proposal | Negotiations ensue; authorized counsel supplies steering. |

| Insurance coverage Firm Rejects Demand | Additional investigation and authorized session to evaluate the power of the case; potential lawsuit. |

| Demand Letter Inadequate | Formal authorized motion, together with submitting a lawsuit, is critical. |

Illustrative Examples of Demand Letters

A requirement letter, a potent instrument within the pursuit of justice, is a fastidiously crafted communication outlining the claimant’s place and searching for a good decision. It is a beacon of readability, illuminating the trail towards reconciliation, and it ought to be seen as a religious providing to the cosmic scales of steadiness.

Hypothetical Automotive Accident State of affairs

A vibrant younger artist, Anya, was traversing a bustling metropolis road on a Tuesday morning, her thoughts brimming with artistic visions. Her automobile was struck by a dashing SUV, pushed by a distracted particular person, Boris. The affect was forceful, inflicting substantial harm to Anya’s automobile and leaving Anya with bodily and emotional trauma. The accident was fully avoidable, a stark reminder of the significance of conscious consideration on the street.

Demand Letter Primarily based on the State of affairs

To [Insurance Company Name],This letter serves as a proper demand for compensation arising from a motorcar accident on [Date of Accident] at roughly [Time of Accident] on [Location of Accident]. Anya, the driving force of [Anya’s Vehicle Make and Model, License Plate Number], was lawfully working her automobile when she was struck by a automobile operated by Boris, the driving force of [Boris’s Vehicle Make and Model, License Plate Number].

The accident was fully on account of Boris’s negligence and reckless disregard for the protection of different street customers.

Supporting Proof and Rationale for the Demand

The demand for compensation is supported by [Police Report Number], the [Witness Statements] and [Photos of the Accident Scene]. The affect of the collision precipitated in depth harm to Anya’s automobile. Additional, Anya skilled important ache and struggling, requiring medical consideration and impacting her capacity to work and pursue her creative endeavors.

Damages Claimed within the Demand Letter

The damages claimed are itemized under, reflecting the tangible and intangible losses incurred by Anya:

- Automobile Restore Prices: [Estimate of repair costs from a qualified mechanic] – This determine represents the required restoration to the pre-accident situation of Anya’s automobile.

- Medical Bills: [Detailed breakdown of medical bills] – This displays the price of Anya’s medical care, together with physician visits, bodily remedy, and any associated bills.

- Misplaced Wages: [Calculation of lost wages due to inability to work] – This encompasses the earnings Anya misplaced throughout her restoration interval.

- Ache and Struggling: [Statement describing the impact of the accident on Anya’s well-being] – This intangible loss accounts for the bodily and emotional misery Anya endured on account of the accident.

- Emotional Misery: [Statement detailing the emotional toll] – This displays the affect of the accident on Anya’s psychological well being.

The entire demand, representing the total measure of Anya’s losses, is [Total Demand Amount].

Breakdown of Damages

| Class | Description | Quantity |

|---|---|---|

| Automobile Restore | Repairing entrance finish harm | $[Amount] |

| Medical Bills | Physician visits and drugs | $[Amount] |

| Misplaced Wages | Misplaced earnings throughout restoration interval | $[Amount] |

| Ache and Struggling | Bodily and emotional misery | $[Amount] |

| Emotional Misery | Affect on psychological well-being | $[Amount] |

| Whole Demand | $[Total Amount] |

Key Arguments within the Hypothetical Demand Letter

- Negligence: Boris’s negligence instantly precipitated the accident.

- Causation: The accident instantly resulted in Anya’s damages.

- Full Compensation: Anya seeks full and honest compensation for all her losses.

- Timeliness: The letter adheres to the statutory deadlines for submitting a declare.

Addressing Particular Kinds of Damages

The trail to simply recompense usually requires a exact articulation of the losses sustained. Understanding the nuances of quantifying medical bills, misplaced wages, ache and struggling, and different non-economic damages is essential to successfully advocating for a good settlement. A transparent and well-documented presentation of those damages is paramount to attaining a passable decision.This course of includes a profound understanding of the intricate internet of things impacting the extent of the losses.

This contains the diligent gathering and meticulous group of proof, which is able to assist your claims and show the true magnitude of your struggling.

Calculating Medical Bills and Documentation

Medical bills are usually calculated by accumulating all documented prices related to therapy and care. This encompasses payments from hospitals, medical doctors, therapists, and some other healthcare suppliers concerned in your restoration. Crucially, these payments should be authenticated with supporting documentation corresponding to receipts, invoices, and doctor statements. Correct record-keeping is important for establishing a transparent timeline of medical care, therapy, and associated bills.

The entire price just isn’t merely the sum of those payments however a complete account that elements in all prices associated to your therapy.

Assessing Misplaced Wages and Supporting Proof

Assessing misplaced wages includes an in depth calculation of the earnings you might have misplaced because of the accident. This contains not solely wage but additionally some other types of earnings, corresponding to bonuses, commissions, or time beyond regulation pay. Documentation of earnings ought to embrace pay stubs, tax returns, employment contracts, and some other related monetary data demonstrating your incomes capability. This proof establishes a transparent image of your pre-accident earnings and the way the accident has impacted your capacity to earn.

Furthermore, any anticipated future earnings losses should even be taken into consideration. Think about using wage statements and employment verification letters out of your employer.

Evaluating Ache and Struggling Damages

Quantifying ache and struggling damages requires a cautious consideration of the bodily and emotional misery skilled because of the accident. This contains each the quick and long-term results, corresponding to continual ache, emotional trauma, and diminished high quality of life. Ache and struggling damages are sometimes assessed via knowledgeable testimony from medical professionals who can consider the severity and length of the accidents.

These professionals can supply detailed assessments of the affect of the accident in your general well-being. These damages will not be simply quantified, however a well-supported narrative, alongside medical opinions, supplies a framework for calculating a good compensation quantity.

Quantifying Non-Financial Damages

Non-economic damages, corresponding to ache and struggling, are extra subjective and require cautious consideration. A key facet in quantifying these damages is offering detailed accounts of the affect the accident has had in your life. This might embrace descriptions of the adjustments in your every day actions, social life, and general well-being. For instance, in the event you can now not interact in hobbies you loved earlier than the accident, this can be a important loss that ought to be factored into the calculation.

Think about together with statements from family and friends who can attest to the adjustments in your persona and life-style. Detailed journals or diaries can present beneficial proof to assist these claims.

Desk of Damages and Supporting Proof

| Kind of Harm | Supporting Proof |

|---|---|

| Medical Bills | Receipts, invoices, doctor statements, payments, and therapy plans |

| Misplaced Wages | Pay stubs, tax returns, employment contracts, and employment verification letters |

| Ache and Struggling | Skilled medical testimony, detailed descriptions of bodily and emotional misery, journals, and diaries. |

| Non-Financial Damages | Statements from family and friends, descriptions of life-style adjustments, and affect on every day actions. |

Ultimate Wrap-Up

In conclusion, a well-crafted automobile accident demand letter to insurance coverage firm is a strong software for navigating the insurance coverage declare course of. This information has explored the important thing parts of this course of, emphasizing the significance of authorized understanding, efficient communication, and strategic negotiation. Bear in mind, meticulous documentation and a radical understanding of the method are essential for a profitable final result. By diligently following the steps Artikeld, you’re well-equipped to pursue your declare with confidence and doubtlessly resolve your case pretty.

Clarifying Questions: Automotive Accident Demand Letter To Insurance coverage Firm

What’s the typical timeframe for responding to a requirement letter?

Insurance coverage corporations usually have a specified timeframe for responding to demand letters, usually Artikeld of their insurance policies or related rules. Failing to obtain a response inside this timeframe might warrant additional motion.

What occurs if the insurance coverage firm rejects the demand?

Rejection of the demand letter might necessitate additional motion, corresponding to exploring various dispute decision strategies or initiating authorized proceedings.

What are the widespread causes for insurance coverage firm rejection of a requirement?

Insurance coverage corporations might reject a requirement on account of inadequate proof, disputes relating to legal responsibility, or disagreements over the calculation of damages.

How can I guarantee my demand letter is legally sound?

Seek the advice of with an legal professional to make sure the demand letter precisely displays the authorized ideas and relevant legal guidelines.