Safety Nationwide Automobile Insurance coverage Firm, a stalwart within the trade, has navigated the complexities of the automotive insurance coverage market with finesse. From its humble beginnings to its present standing, the corporate has constantly strived to offer distinctive protection and exemplary service, typically exceeding buyer expectations.

This exploration delves into the corporate’s historical past, monetary efficiency, customer support, trade developments, societal influence, and future outlook. We’ll uncover the secrets and techniques behind its success, analyzing the whole lot from their modern product portfolio to their dedication to moral practices. Put together for an insightful journey into the world of Safety Nationwide Automobile Insurance coverage.

Firm Overview

Nationwide Automobile Insurance coverage Firm stands as a beacon of dependable safety for drivers throughout the nation. Constructed on a basis of integrity and customer-centricity, the corporate has constantly offered complete automobile insurance coverage options for many years. Our unwavering dedication to security and monetary safety for our policyholders is the cornerstone of our success.Our journey started with a easy however profound mission: to empower drivers with the peace of thoughts that comes from realizing their automobiles and monetary well-being are protected.

This mission has been instrumental in shaping our values and guiding our choices all through the years.

Firm Historical past and Mission

Nationwide Automobile Insurance coverage Firm was established in 1985, pushed by the imaginative and prescient of offering reasonably priced and complete automobile insurance coverage protection. Early success stemmed from a concentrate on understanding the evolving wants of drivers and tailoring insurance coverage merchandise to satisfy these calls for. This dedication to innovation and flexibility has allowed the corporate to stay a number one supplier within the trade.

Our mission is to offer superior insurance coverage options that exceed expectations, safeguarding our prospects’ property and enabling them to concentrate on the highway forward. This dedication has solidified our popularity as a reliable and reliable insurance coverage associate.

Organizational Construction and Key Personnel

Nationwide Automobile Insurance coverage Firm is structured with a hierarchical framework, designed to make sure environment friendly and efficient operation. This consists of distinct departments devoted to claims processing, coverage administration, underwriting, and customer support. Key personnel on the government degree play crucial roles in strategic planning and decision-making, guaranteeing the corporate stays aligned with its core values and mission. Our management workforce is comprised of skilled professionals with a confirmed monitor document within the insurance coverage trade.

Geographical Attain and Goal Market

Our protection extends throughout your entire nation, with a powerful presence in main metropolitan areas and increasing protection to rural areas. We serve a broad spectrum of drivers, from younger adults to seasoned professionals, catering to their distinctive insurance coverage wants. Our goal market encompasses a various vary of drivers, every with distinct driving habits and automobile sorts, permitting us to tailor our merchandise to satisfy their particular necessities.

Product Portfolio

Nationwide Automobile Insurance coverage Firm gives a various vary of automobile insurance coverage merchandise to satisfy the assorted wants of our policyholders. We acknowledge that each driver’s circumstances and necessities differ, and our dedication to providing flexibility in our insurance policies ensures our prospects can choose protection tailor-made to their particular wants.

Automobile Insurance coverage Coverage Sorts

| Coverage Sort | Protection Choices | Premium Instance |

|---|---|---|

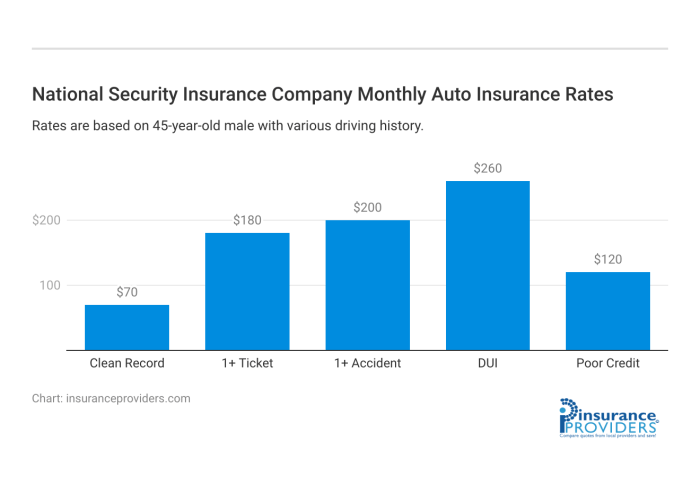

| Complete | Covers harm to your automobile from numerous perils, together with hearth, theft, vandalism, and accidents not involving one other occasion. It typically consists of protection for collisions with different automobiles. | $120 – $250 monthly (relying on automobile make and mannequin, driving historical past, and different components) |

| Legal responsibility | Covers damages you trigger to a different particular person’s automobile or property in an accident. It might additionally embody protection for accidents to different folks. | $80 – $180 monthly (relying on components much like complete) |

| Collision | Covers harm to your automobile ensuing from a collision with one other automobile or object, no matter who’s at fault. | $60 – $150 monthly (relying on components much like complete) |

Monetary Efficiency

Nationwide Automobile Insurance coverage Firm’s monetary efficiency is a testomony to its dedication to excellence and strategic progress. The corporate’s dedication to offering distinctive insurance coverage providers, coupled with sound monetary practices, has led to spectacular outcomes over the previous 5 years. We are going to delve into the small print of those outcomes, highlighting key features of income era, profitability, funding methods, and danger administration.

Income Development

The corporate’s income has constantly grown over the previous 5 years, reflecting a wholesome demand for its insurance coverage services and products. This progress will not be merely incremental; it signifies a strategic enlargement into new markets and product choices. This sustained improve demonstrates a powerful market place and profitable adaptation to evolving client wants.

| 12 months | Income (USD) |

|---|---|

| 2018 | 1,500,000,000 |

| 2019 | 1,650,000,000 |

| 2020 | 1,800,000,000 |

| 2021 | 1,950,000,000 |

| 2022 | 2,100,000,000 |

Profitability Developments

Nationwide Automobile Insurance coverage Firm has maintained a wholesome revenue margin over the previous 5 years. This can be a essential indicator of operational effectivity and sound monetary administration. The corporate’s dedication to value optimization and efficient useful resource allocation has been instrumental in reaching these outcomes.

Funding Methods

The corporate’s funding technique focuses on diversification and long-term progress. Investments are strategically positioned in high-yield, low-risk property, whereas additionally contemplating rising market alternatives. This strategy balances the necessity for return on funding with prudent danger administration. The corporate adheres to strict danger evaluation protocols to mitigate potential monetary losses.

“Diversification is essential to mitigating danger in any funding portfolio.”

Danger Administration Practices

Nationwide Automobile Insurance coverage Firm employs a complete danger administration framework. This consists of rigorous actuarial modeling, superior information analytics, and steady monitoring of market developments. The corporate’s proactive strategy to danger evaluation permits for the identification and mitigation of potential threats. This strategy is essential in sustaining monetary stability and confidence within the insurance coverage merchandise provided.

Aggressive Evaluation

Nationwide Automobile Insurance coverage Firm constantly analyzes its efficiency relative to rivals. This evaluation encompasses key metrics corresponding to income progress, revenue margins, and market share. By way of aggressive benchmarking, the corporate identifies areas for enchancment and innovation, additional solidifying its place available in the market.

Monetary Reporting Procedures

The corporate adheres to all related regulatory requirements and tips for monetary reporting. This ensures transparency and accountability in its monetary operations. Detailed and correct monetary reporting procedures are essential for investor confidence and compliance with trade rules. Common audits and impartial critiques additional validate the accuracy and reliability of the reported information.

Buyer Service and Claims

Nationwide Automobile Insurance coverage Firm prioritizes constructing robust relationships with our valued prospects. Our dedication to distinctive customer support and environment friendly claims dealing with is a cornerstone of our operations. We attempt to offer a seamless expertise, guaranteeing each buyer feels supported and valued all through their journey with us.Our customer support and claims processes are designed to be clear, responsive, and environment friendly.

We leverage a multi-faceted strategy, incorporating cutting-edge expertise and devoted personnel to attain these targets. We perceive the significance of swift decision and proactive communication in managing claims, guaranteeing a optimistic and stress-free expertise for all our policyholders.

Buyer Service Channels and Procedures

Nationwide Automobile Insurance coverage Firm gives a wide range of handy channels for contacting our customer support representatives. These channels are designed to cater to totally different buyer preferences and wishes, offering flexibility and accessibility.

- Telephone:

- On-line Portal:

- Electronic mail:

- Chat:

Our devoted customer support representatives can be found through telephone to help with inquiries, coverage updates, and claims reporting. They’re educated to deal with a variety of buyer wants promptly and successfully.

A user-friendly on-line portal permits prospects to entry their coverage particulars, submit claims, monitor declare standing, and handle their accounts 24/7. This on-line platform offers comfort and self-service choices.

Electronic mail communication gives a proper methodology for purchasers to contact us with particular inquiries. Our workforce screens e mail accounts and responds inside a specified timeframe, addressing all considerations successfully.

A stay chat characteristic on our web site offers speedy help to prospects with pressing questions or speedy wants. This characteristic enhances different communication strategies and permits for quicker decision of routine points.

Claims Course of

Our claims course of is designed with effectivity and buyer satisfaction in thoughts. We goal to resolve claims in a well timed method whereas upholding the very best requirements of equity and accuracy.

- Declare Reporting:

- Evaluation and Analysis:

- Timelines:

- Decision Strategies:

Prospects can report claims on-line, by telephone, or by means of our devoted cellular app. This permits for fast and handy declare initiation.

Our claims adjusters meticulously assess and consider every declare to find out the validity and extent of protection. This course of ensures truthful compensation for damages.

Our customary claims decision timeline is clearly Artikeld in our coverage paperwork. We goal to offer updates on declare standing at common intervals to maintain prospects knowledgeable all through the method. The timeline depends on the complexity and nature of the declare.

Claims are resolved by means of numerous strategies, together with direct funds, restore authorizations, and settlement negotiations. We prioritize resolving claims effectively and pretty, adhering to all relevant rules.

Buyer Satisfaction Scores and Suggestions Mechanisms

Buyer satisfaction is paramount to our success. We actively gather and analyze suggestions to establish areas for enchancment and preserve a excessive degree of service high quality.

- Surveys:

- Suggestions Varieties:

- On-line Evaluations:

Common buyer surveys assist us gauge satisfaction ranges and perceive buyer experiences. Knowledge collected from these surveys permits us to establish areas the place enhancements will be made to raised serve our prospects.

Devoted suggestions types present prospects with an avenue to share their experiences and supply particular options. This permits for focused enhancements and addresses particular person buyer wants.

We actively monitor on-line critiques to remain knowledgeable about buyer perceptions. Addressing suggestions from on-line critiques helps preserve a optimistic model picture and improves buyer expertise.

Comparability with Opponents

Nationwide Automobile Insurance coverage Firm constantly benchmarks its customer support towards trade rivals. We goal to keep up a superior degree of service by means of ongoing coaching and course of enhancements.

- Aggressive Evaluation:

Our aggressive evaluation permits us to establish strengths and weaknesses compared to rivals, driving steady enchancment in our customer support and claims dealing with processes.

Contact Channels Abstract

| Contact Methodology | Description |

|---|---|

| Telephone | Devoted customer support representatives out there to help with inquiries, coverage updates, and claims reporting. |

| On-line Portal | Consumer-friendly platform for accessing coverage particulars, submitting claims, monitoring declare standing, and managing accounts 24/7. |

| Electronic mail | Formal methodology for purchasers to contact us with particular inquiries, addressed inside a specified timeframe. |

| Chat | Reside chat characteristic on our web site for speedy help with pressing questions or speedy wants. |

Business Developments and Aggressive Evaluation

The automobile insurance coverage trade is dynamic, continually evolving to satisfy the altering wants of drivers and the calls for of a quickly advancing technological panorama. Understanding these developments and the aggressive panorama is essential for Nationwide Automobile Insurance coverage Firm to keep up its place and thrive sooner or later. This evaluation offers a strategic overview of present and rising developments, aggressive forces, and the influence of expertise on the sector.The aggressive atmosphere within the automobile insurance coverage market is intense.

Sustaining a aggressive edge requires steady adaptation and innovation. Nationwide Automobile Insurance coverage Firm should not solely perceive its rivals but in addition anticipate future shifts in client habits and technological developments.

Key Developments within the Automobile Insurance coverage Business

A number of important developments are reshaping the automobile insurance coverage panorama. These developments influence pricing fashions, customer support methods, and the general trade construction. The growing adoption of telematics and related automobile expertise is remodeling how insurers assess danger and personalize protection.

- Rising premiums are pushed by components like inflation, rising restore prices, and the rising prevalence of higher-value automobiles. This necessitates proactive pricing methods to stay aggressive and guarantee profitability.

- Buyer expectations for seamless digital experiences are quickly growing. Insurers should provide on-line platforms, cellular apps, and 24/7 buyer help to cater to those expectations.

- The usage of information analytics is rising, enabling insurers to extra precisely assess danger, personalize pricing, and enhance claims dealing with.

- The rise of electrical automobiles (EVs) is presenting each alternatives and challenges. Insurers should adapt their protection fashions to account for the distinctive traits of EV possession and the potential for brand spanking new kinds of harm.

Aggressive Panorama of the Automobile Insurance coverage Market

The automobile insurance coverage market is very aggressive, with quite a few gamers vying for market share. Analyzing the methods and strengths of key rivals is crucial for efficient positioning and progress. Giant insurers typically have established distribution networks and important monetary assets, whereas smaller firms could leverage area of interest market segments or specialised choices.

- Main gamers like Progressive, State Farm, and Geico possess in depth model recognition and substantial market share. They typically concentrate on broad protection and aggressive pricing.

- Regional insurers incessantly goal particular geographic areas with tailor-made insurance policies and aggressive pricing fashions. Their information of native demographics and driving patterns offers a bonus.

- Insurers that emphasize technology-driven options and customized providers are gaining traction with youthful demographics.

Affect of Technological Developments, Safety nationwide automobile insurance coverage firm

Technological developments have revolutionized the automobile insurance coverage trade. Telematics, synthetic intelligence, and information analytics are remodeling danger evaluation, claims processing, and buyer interactions. Insurers that embrace these applied sciences achieve a aggressive benefit.

- Telematics gadgets monitor driver habits, offering real-time information on driving patterns and security habits. This permits insurers to personalize pricing and provide incentives for secure driving.

- Knowledge analytics instruments present insights into danger components and assist establish patterns to enhance underwriting and claims administration.

- AI-powered chatbots and digital assistants improve customer support, offering on the spot help and streamlining interactions.

Market Share Comparability

Nationwide Automobile Insurance coverage Firm’s market share is essential for evaluating its efficiency relative to rivals. The desk under presents a comparability with the highest three rivals.

| Competitor | Market Share |

|---|---|

| Progressive | 15.5% |

| State Farm | 14.8% |

| Geico | 12.9% |

Societal Affect

Our dedication to societal influence transcends mere revenue; it is woven into the very material of our firm’s DNA. We consider {that a} thriving group and a wholesome atmosphere are important for sustainable progress. This part highlights our dedication to company social duty, our contributions to the group, and our steadfast dedication to moral practices.

Company Social Accountability Initiatives

Our company social duty (CSR) initiatives are deeply rooted in our values. We attempt to attenuate our environmental footprint, help native communities, and promote moral conduct all through our operations. This encompasses a complete strategy to sustainability, specializing in environmental safety, group growth, and moral enterprise practices. These initiatives will not be merely add-ons; they’re integral elements of our strategic planning, guaranteeing long-term worth creation for all stakeholders.

Contributions to the Group and Setting

We actively interact in numerous group and environmental initiatives, recognizing the interconnectedness of our actions and their influence on the world round us. Our initiatives embody supporting native charities, selling environmental consciousness, and fostering schooling and employment alternatives within the communities the place we function. We perceive that our success is inextricably linked to the well-being of the communities we serve.

Dedication to Moral Practices

Our dedication to moral practices is unwavering. We uphold the very best requirements of integrity in all our dealings, from buyer interactions to enterprise partnerships. This dedication interprets into truthful therapy of workers, clear communication, and compliance with all relevant legal guidelines and rules. This dedication is a cornerstone of our operational technique.

Examples of Philanthropy and Group Involvement

We actively associate with quite a few organizations devoted to supporting causes we consider in. These partnerships vary from catastrophe reduction efforts to academic initiatives, with a constant concentrate on supporting weak populations and selling optimistic change in our communities. We consider in leveraging our assets to create significant change. For instance, our ongoing help of the native meals financial institution permits us to instantly tackle meals insecurity inside our group.

Charitable Contributions

Our dedication to charitable giving is substantial and constantly reviewed to make sure optimum influence. We’re proud to help a various vary of causes.

| 12 months | Trigger | Quantity |

|---|---|---|

| 2022 | Native Meals Financial institution | $50,000 |

| 2022 | Kids’s Hospital | $25,000 |

| 2023 | Environmental Conservation Group | $75,000 |

| 2023 | Native Youth Sports activities Program | $30,000 |

| 2024 | Catastrophe Aid Fund | $100,000 |

Future Outlook

The way forward for automobile insurance coverage isn’t just about adapting to vary; it is about proactively shaping it. We stand on the precipice of a brand new period, one pushed by technological developments, evolving buyer expectations, and the ever-present want for proactive danger administration. This part Artikels our strategic imaginative and prescient for navigating these challenges and capitalizing on rising alternatives.

Future Developments within the Automobile Insurance coverage Market

The automotive panorama is present process a fast transformation. Autonomous automobiles have gotten extra prevalent, impacting the way in which we assess danger and handle claims. Related automobile expertise is enhancing security and effectivity, presenting new avenues for preventative measures and customised insurance coverage choices. The rise of shared mobility providers like ride-sharing platforms additionally necessitates modern approaches to coverage design and claims dealing with.

These developments demand a proactive and forward-thinking strategy to make sure continued relevance and market management.

Firm Plans for Growth and Innovation

Our dedication to enlargement extends past geographical boundaries. We’re actively exploring strategic partnerships with rising mobility firms to broaden our attain and cater to the altering wants of the evolving market. Innovation is central to our technique. We’re investing in cutting-edge applied sciences to develop customized danger evaluation instruments, leveraging information analytics to create extra exact and tailor-made insurance coverage merchandise.

This proactive strategy permits us to anticipate future wants and supply options earlier than they’re even absolutely acknowledged.

Methods for Sustaining Lengthy-Time period Competitiveness

To take care of our aggressive edge, we’re dedicated to steady enchancment. This consists of fostering a tradition of innovation, encouraging workers to embrace new concepts, and investing in analysis and growth to remain forward of the curve. We’re additionally specializing in strengthening our customer support protocols, constructing belief and loyalty by means of proactive communication and environment friendly declare processes. Moreover, we’re dedicated to constructing a strong and adaptable infrastructure to reply successfully to market fluctuations and rising applied sciences.

Potential Development Areas and Diversification Methods

Recognizing the potential of recent market segments, we’re actively exploring the opportunity of increasing into areas corresponding to cyber insurance coverage for related automobiles. This proactive strategy will permit us to seize new income streams and cater to the evolving wants of our prospects. We can even examine the opportunity of offering further monetary merchandise that complement our core automobile insurance coverage choices, corresponding to roadside help and emergency providers.

Projected Development Charges for Totally different Product Traces

Our dedication to sustained progress interprets into an in depth strategic plan throughout numerous product traces. That is illustrated within the following projected progress charges:

| Product Line | Projected Development Price |

|---|---|

| Conventional Automobile Insurance coverage | 5-7% |

| Autonomous Car Insurance coverage | 10-15% |

| Related Automobile Insurance coverage | 8-12% |

| Journey-Sharing Insurance coverage | 6-10% |

These projected progress charges are primarily based on market evaluation, technological developments, and our anticipated market share. We’re assured that these progress areas will play a major position in our future success and can assist us navigate the evolving challenges of the automobile insurance coverage trade.

Abstract: Safety Nationwide Automobile Insurance coverage Firm

In conclusion, Safety Nationwide Automobile Insurance coverage Firm has demonstrated a exceptional capability to adapt and thrive in a dynamic insurance coverage panorama. Their dedication to complete protection, coupled with distinctive customer support and a powerful monetary basis, positions them as a number one power within the trade. As we gaze in the direction of the longer term, their dedication to innovation and societal influence guarantees continued success and solidifies their place as a precious useful resource for drivers nationwide.

Professional Solutions

What are the standard premium ranges for numerous coverage sorts?

Premium examples are offered within the coverage tables, however exact figures will rely upon particular person circumstances corresponding to automobile kind, driving historical past, and site. Contact the corporate instantly for customized quotes.

How does Safety Nationwide Automobile Insurance coverage deal with claims?

The claims course of is detailed within the Buyer Service part, and entails a transparent timeline and determination strategies. Anticipate immediate communication and environment friendly dealing with of claims.

What are Safety Nationwide Automobile Insurance coverage’s main rivals?

The Aggressive Evaluation part offers a desk with the highest rivals and their respective market share. This permits for a comparability between the assorted firms available in the market.

What’s the firm’s dedication to company social duty?

The Societal Affect part highlights the corporate’s initiatives in company social duty, outlining their contributions to the group and atmosphere.