How a lot is automobile insurance coverage in South Carolina monthly? Navigating the state’s insurance coverage panorama can really feel like a maze, however concern not, intrepid drivers! This information unveils the secrets and techniques to deciphering South Carolina’s month-to-month automobile insurance coverage prices, from the components that impression your premium to savvy methods for saving. Get able to unlock the code to reasonably priced automobile insurance coverage.

We’ll discover the important thing variables influencing your charges, like your driving historical past and automobile sort, plus delve into the typical prices throughout totally different demographics. Plus, we’ll uncover insider tricks to reduce prices and spotlight the professionals and cons of assorted insurance coverage suppliers. Buckle up, as a result of this trip to understanding South Carolina automobile insurance coverage is about to get fascinating!

Elements Affecting Automobile Insurance coverage Prices in South Carolina

Navigating the world of automobile insurance coverage can really feel like deciphering a posh code. Understanding the components that affect premiums in South Carolina is essential for making knowledgeable selections and securing the very best charges. Figuring out what components play a job empowers you to take management of your insurance coverage prices.Automobile insurance coverage premiums in South Carolina, like many different states, aren’t a set quantity.

They’re dynamic and calculated primarily based on quite a lot of parts that instantly impression danger evaluation. Insurance coverage corporations meticulously consider every facet to find out the suitable premium for every policyholder. This includes taking a look at your driving historical past, the automobile itself, your location, and your age. Past these elementary components, particular South Carolina rules and the way totally different insurance coverage corporations interpret them additionally play a big function.

Driving Historical past

Driving historical past is a essential element in figuring out your automobile insurance coverage premium. A clear driving document, with no accidents or violations, usually interprets to decrease premiums. Conversely, accidents, visitors violations, or claims will normally end in greater premiums. This displays the insurance coverage firm’s evaluation of your danger profile as a driver. For instance, a driver with a number of rushing tickets will seemingly pay greater than a driver with no violations.

Car Kind

The kind of automobile you drive considerably impacts your insurance coverage prices. Sure autos are inherently dearer to insure than others resulting from their perceived danger of injury or theft. Sports activities vehicles, luxurious autos, and high-performance fashions typically carry greater premiums in comparison with commonplace sedans or compact vehicles. That is due to components just like the potential for greater restore prices and the perceived desirability of the automobile to thieves.

Location

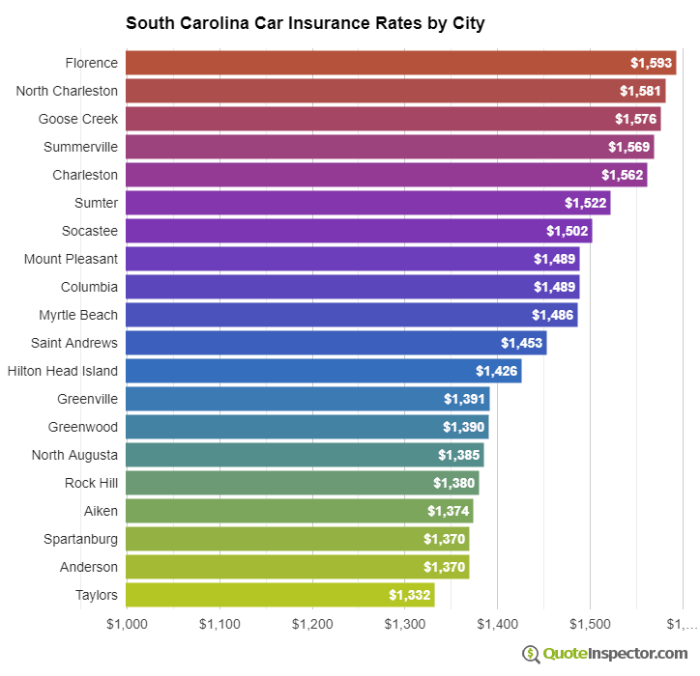

Your location in South Carolina also can have an effect on your automobile insurance coverage charges. Areas with greater crime charges or a higher focus of accidents typically see greater premiums. For example, a driver residing in a metropolis identified for high-speed driving or accidents could pay extra in comparison with a driver in a extra rural space with a decrease incident charge.

This displays the insurance coverage firm’s analysis of danger primarily based on the particular demographics and traits of the world.

Age of Driver

The age of the driving force is a key consider figuring out insurance coverage premiums. Youthful drivers are usually thought-about greater danger and due to this fact pay greater premiums. This is because of their inexperience and, doubtlessly, a better probability of accidents. This can be a widespread observe throughout numerous insurance coverage markets, and South Carolina isn’t any exception. Nevertheless, as drivers acquire expertise and a clear driving document, their premiums usually lower.

Affect of South Carolina Rules

South Carolina rules, like necessary minimal legal responsibility protection necessities or particular legal guidelines relating to uninsured motorists, not directly have an effect on insurance coverage charges. These rules affect the extent of danger related to totally different drivers and autos. The state’s necessities for protection quantities and kinds instantly impression the price of insurance coverage for people.

Insurance coverage Firm Variations

Totally different insurance coverage corporations in South Carolina could assess these components otherwise. Their danger evaluation fashions, pricing methods, and inner procedures would possibly range. Because of this a driver with an analogous profile would possibly get hold of totally different premiums from totally different corporations. For instance, Firm A would possibly weigh rushing tickets extra closely than Firm B.

| Issue | Description | Affect on Premium |

|---|---|---|

| Driving Historical past | Quantity and severity of accidents and violations | Larger danger, greater premium; clear document, decrease premium |

| Car Kind | Mannequin, make, 12 months, and options of the automobile | Larger worth/efficiency, greater premium; commonplace fashions, decrease premium |

| Location | Crime charges, accident frequency, and demographics of the world | Excessive-risk areas, greater premium; low-risk areas, decrease premium |

| Age of Driver | Expertise degree and driving historical past of the driving force | Youthful drivers, greater premium; older drivers with expertise, decrease premium |

Common Automobile Insurance coverage Prices in South Carolina

Navigating the world of automobile insurance coverage can really feel like a maze, particularly in a state like South Carolina, with its distinctive mix of demographics and driving situations. Understanding the typical prices might help you price range successfully and store for the very best charges.

Elements akin to your automobile sort, age, driving document, and even the particular insurance coverage firm all play a vital function in figuring out your month-to-month premium. This part will delve into the everyday month-to-month automobile insurance coverage prices throughout numerous demographics in South Carolina, offering a clearer image of what you would possibly count on to pay.

Common Month-to-month Prices Throughout Demographics

South Carolina’s automobile insurance coverage panorama reveals a variety of common month-to-month prices relying on components past simply the automobile itself. Age and driving expertise considerably affect premiums, as youthful drivers usually face greater charges in comparison with extra skilled drivers. Likewise, drivers with a clear driving document typically get pleasure from decrease charges in comparison with these with previous accidents or violations.

Common Month-to-month Charges by Car Kind

The kind of automobile you drive additionally impacts your insurance coverage prices. Sedans, usually lighter and fewer highly effective than SUVs or vehicles, are likely to have decrease premiums. That is typically because of the decrease danger of injury in accidents. Bigger autos, like SUVs and vehicles, have a tendency to hold a better restore value, resulting in correspondingly greater insurance coverage premiums.

| Car Kind | Common Month-to-month Price |

|---|---|

| Sedan | $50-$100 |

| SUV | $60-$120 |

| Truck | $70-$150 |

Observe: These are approximate ranges and may range tremendously primarily based on different components akin to the particular make and mannequin of the automobile, add-ons or particular tools, and the insurance coverage firm.

Common Month-to-month Charges Primarily based on Driver Age and Expertise

A major issue influencing your month-to-month premium is your age and driving expertise. Youthful drivers typically have greater premiums as a result of they’re statistically extra liable to accidents than older, extra skilled drivers. The insurance coverage corporations take this into consideration to evaluate the chance they’re assuming along with your coverage.

For instance, a younger driver with restricted expertise would possibly pay $150-$250 monthly, whereas a extra skilled driver of their 30s or 40s would possibly pay $75-$150 monthly. The hole in prices might be substantial, highlighting the significance of constructing a robust driving document and doubtlessly in search of reductions.

Comparability of Common Prices Between Insurance coverage Corporations

Insurance coverage corporations in South Carolina supply quite a lot of plans with totally different options and prices. Some corporations would possibly emphasize complete protection, whereas others would possibly give attention to decrease premiums. Evaluating quotes from a number of corporations is essential for getting one of the best worth on your protection wants.

A comparability of common month-to-month charges from just a few main insurance coverage suppliers in South Carolina would reveal a distinction of their pricing. This distinction may very well be because of their danger evaluation and pricing methods. Elements like firm fame, customer support, and coverage options are different key concerns to have in mind when choosing an insurance coverage supplier.

Methods to Scale back Automobile Insurance coverage Prices in South Carolina

Savvy South Carolina drivers can considerably scale back their automobile insurance coverage premiums by implementing good methods. Understanding the components influencing prices, and taking proactive steps to enhance your driving document and protection decisions, can result in substantial financial savings. These methods, tailor-made to the South Carolina market, empower you to manage your insurance coverage bills.Enhancing your driving document is a key consider reducing your automobile insurance coverage premiums.

A clear driving historical past demonstrates accountable habits on the street, which insurers worth.

Sustaining a Clear Driving Report

A spotless driving document is paramount in securing favorable automobile insurance coverage charges. Avoiding accidents and visitors violations is essential. South Carolina, like many states, makes use of a degree system to evaluate driving historical past. Factors accumulate for violations, akin to rushing tickets, reckless driving, and shifting violations. The next level complete instantly correlates with greater insurance coverage premiums.

Proactively avoiding these infractions is crucial for sustaining a positive driving document and making certain decrease insurance coverage prices. Repeatedly reviewing your driving document for any collected factors is beneficial to handle any potential points promptly.

Taking Defensive Driving Programs

Defensive driving programs present invaluable abilities and information to reinforce your driving habits and scale back the chance of accidents. Finishing a licensed defensive driving course in South Carolina can typically result in important reductions on automobile insurance coverage premiums. These programs give attention to recognizing and avoiding potential hazards, growing higher judgment, and enhancing response instances. Collaborating in such programs demonstrates your dedication to secure driving practices, which insurers acknowledge as a constructive issue when figuring out insurance coverage charges.

This proactive strategy not solely lowers your insurance coverage premiums but in addition contributes to a safer driving surroundings.

Contemplating Including a Security Machine

Putting in security units in your automobile, akin to an anti-theft system or superior security options, generally is a good technique to cut back your automobile insurance coverage prices. Insurers typically present reductions for autos outfitted with such options, recognizing the improved security they provide. For instance, in case you add an anti-theft gadget to your automobile, your insurance coverage firm would possibly supply a reduction in your premiums.

This demonstrates a dedication to automobile safety and will end in decrease insurance coverage premiums.

Selecting the Proper Insurance coverage Protection

Fastidiously choosing the fitting insurance coverage protection is essential to minimizing automobile insurance coverage prices. Complete protection, whereas providing broader safety, could enhance premiums. Understanding the particular dangers in your space and private driving habits will enable you to decide the suitable protection. For example, drivers residing in high-theft areas would possibly profit from greater complete protection. Selecting the best stability of protection and value is crucial.

Reductions Supplied by Insurance coverage Suppliers in South Carolina

Insurance coverage suppliers in South Carolina typically supply numerous reductions for particular actions or automobile traits. These reductions can range relying on the supplier. For instance, some suppliers supply reductions for good pupil drivers, secure driver applications, or for having a automobile with superior security options. By making the most of accessible reductions, you may doubtlessly save important cash in your automobile insurance coverage premiums.

Actions Drivers Can Take to Decrease Their Premiums

- Keep a clear driving document: Keep away from visitors violations and accidents to maintain your insurance coverage prices low. This can be a elementary facet of accountable driving and a big consider sustaining a positive driving document.

- Take a defensive driving course: Improve your driving abilities and information to cut back the chance of accidents. Many insurers supply reductions for drivers who full defensive driving programs.

- Take into account including a security gadget: Set up anti-theft programs or superior security options in your automobile. Insurers typically present reductions for autos with such options.

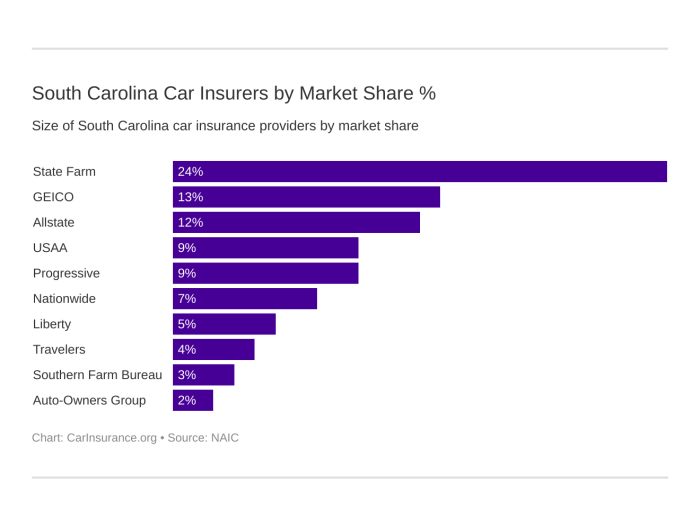

Comparability of Insurance coverage Suppliers in South Carolina: How A lot Is Automobile Insurance coverage In South Carolina Per Month

Navigating the automobile insurance coverage panorama in South Carolina can really feel like a treasure hunt. Totally different corporations supply various ranges of protection and pricing, making the decision-making course of fairly complicated. Understanding the methods employed by key suppliers is essential to discovering one of the best match on your wants and price range.

Evaluating Pricing Methods, How a lot is automobile insurance coverage in south carolina monthly

Insurance coverage corporations in South Carolina make use of numerous pricing methods, reflecting components like danger evaluation, market competitors, and revenue margins. Some suppliers give attention to aggressive fundamental packages, whereas others emphasize complete protection with add-on choices. This variability permits drivers to tailor their protection to particular necessities and monetary conditions.

Figuring out Corporations Identified for Aggressive Pricing

A number of insurers in South Carolina are identified for his or her aggressive pricing. These corporations typically leverage economies of scale, environment friendly claims processing, and progressive applied sciences to maintain prices low for policyholders. Elements like driver historical past, automobile sort, and geographic location additionally affect pricing. For example, drivers with a clear driving document typically qualify for decrease premiums.

Evaluating Buyer Service Repute

Customer support performs an important function within the insurance coverage expertise. Corporations identified for wonderful customer support typically obtain constructive suggestions from policyholders. That is particularly necessary throughout declare processes, the place clear communication and well timed decision are paramount. Immediate response instances, useful assist representatives, and easy communication are hallmarks of a robust customer support fame.

Comparative Evaluation of Insurance coverage Suppliers

This desk gives a comparative overview of key insurance coverage suppliers in South Carolina, highlighting their pricing methods and customer support scores.

| Insurance coverage Supplier | Pricing Technique | Buyer Service Score |

|---|---|---|

| Firm A | Focuses on bundled reductions and provides aggressive charges for younger drivers with good driving data. Usually makes use of on-line instruments for straightforward coverage administration. | 4.5 out of 5 stars primarily based on buyer critiques, with robust emphasis on on-line assist and fast claims decision. |

| Firm B | Emphasizes complete protection packages with customizable add-ons, and infrequently targets households and drivers with a number of autos. Provides reductions for accident prevention programs. | 4.2 out of 5 stars primarily based on critiques, with a robust fame for in-person assist and customized service, particularly throughout complicated declare processes. |

| Firm C | Identified for aggressive fundamental protection packages, splendid for drivers in search of cost-effective insurance coverage. Usually makes use of digital instruments for coverage administration and on-line declare reporting. | 4.0 out of 5 stars primarily based on critiques, with persistently constructive suggestions relating to on-line assist, environment friendly claims processing, and easy coverage info. |

Illustrative Case Research for South Carolina Insurance coverage Prices

Navigating the world of automobile insurance coverage can really feel like deciphering a posh code. Understanding how numerous components affect your premiums is vital to securing the very best charges in South Carolina. These case research will illuminate how totally different conditions have an effect on insurance coverage prices, providing sensible insights into accountable driving and good monetary selections.These examples showcase how quite a lot of components, from driving historical past to automobile sort, impression your month-to-month premium.

By inspecting these situations, you may acquire a clearer image of the best way to doubtlessly decrease your insurance coverage prices and make knowledgeable decisions to guard your funds.

Affect of Driving Report on Premiums

A pristine driving document is a invaluable asset in terms of automobile insurance coverage in South Carolina. A clear driving historical past demonstrates accountable habits on the street, which insurance coverage corporations typically reward with decrease premiums.

- A driver with no accidents or visitors violations will seemingly obtain a decrease premium than a driver with a historical past of rushing tickets or at-fault accidents. It is because a clear document signifies a decrease danger of future claims, permitting insurers to supply extra favorable charges.

- For instance, take into account two drivers with comparable autos and protection ranges. Driver A has a clear document, whereas Driver B has a latest rushing ticket. Driver A’s premiums will seemingly be considerably decrease resulting from their demonstrably secure driving habits.

Affect of Car Kind and Options on Prices

The make, mannequin, and options of your automobile play a big function in figuring out your insurance coverage premium. Sure autos are extra inclined to break or theft, resulting in greater insurance coverage prices.

- Excessive-performance sports activities vehicles or luxurious autos typically include greater insurance coverage premiums in comparison with extra commonplace autos. The perceived greater danger of injury or theft contributes to those elevated prices.

- Security options, akin to anti-theft units, airbags, and digital stability management, can considerably affect premiums. Vehicles outfitted with superior security options are likely to have decrease premiums, reflecting their diminished danger of accidents.

Affect of Location and Protection on Insurance coverage Premiums

Your location in South Carolina and the kind of protection you select also can impression your month-to-month premiums.

- Areas with greater charges of accidents or theft could have correspondingly greater insurance coverage charges. That is because of the elevated danger of claims in these areas, which insurers issue into their pricing fashions.

- Selecting complete protection, which protects in opposition to harm to your automobile from numerous occasions, could enhance your premiums. Nevertheless, this kind of protection can present important monetary safety in case of an accident or different unexpected circumstances.

Price-Saving Measures for South Carolina Drivers

A number of methods might help drivers in South Carolina scale back their automobile insurance coverage prices.

- Bundling Insurance coverage Insurance policies: Combining your auto insurance coverage with householders or renters insurance coverage can generally result in reductions.

- Elevating Your Deductible: Rising your deductible can typically end in a decrease premium, however be ready to pay a better out-of-pocket value within the occasion of an accident.

- Taking a Defensive Driving Course: Finishing a defensive driving course can exhibit accountable driving habits and infrequently end in diminished premiums.

- Store Round for Quotes: Evaluating quotes from a number of insurance coverage suppliers is essential. This lets you discover the very best charges tailor-made to your particular wants.

Final Level

So, there you may have it – a complete take a look at how a lot automobile insurance coverage prices in South Carolina monthly. We have uncovered the essential components that form your premiums, out of your driving document to your automobile. Armed with this information, you are higher outfitted to buy one of the best offers and discover the right insurance coverage plan to suit your price range and wishes.

Now, go forth and safe your wheels!

FAQs

What is the common automobile insurance coverage value for a younger driver in South Carolina?

Younger drivers typically face greater premiums resulting from perceived greater danger. The precise quantity varies considerably relying on components like the particular insurance coverage firm, automobile sort, and placement. Nevertheless, count on to pay greater than the typical, and store round to search out probably the most aggressive charges.

Are there reductions accessible for good drivers in South Carolina?

Completely! Many insurers supply reductions for secure drivers, those that full defensive driving programs, and those that preserve a clear driving document. Examine your choices with totally different suppliers to see which reductions apply to you.

How does my automobile have an effect on my insurance coverage value in South Carolina?

The kind of automobile you drive performs a considerable function. Excessive-performance vehicles and luxurious autos typically entice greater premiums in comparison with commonplace fashions. This is because of components just like the perceived danger of injury and theft, in addition to the price of repairs. Be sure you issue this into your price range when evaluating totally different insurance coverage choices.