Santa Ana automobile insurance coverage charges: navigating the complexities of protection within the metropolis. From understanding the components that drive up or down your premium to evaluating insurance coverage suppliers, this information breaks down the ins and outs of securing one of the best deal. Find out about site visitors patterns, security knowledge, and cost-saving methods. Your final useful resource for getting essentially the most reasonably priced protection.

Uncover the secrets and techniques behind Santa Ana automobile insurance coverage charges. We delve into the components that have an effect on your premium, out of your driving report to your automobile sort. Uncover how site visitors knowledge correlates to charges, and uncover cost-saving methods tailor-made to Santa Ana drivers. Get able to unlock one of the best insurance coverage offers.

Components Influencing Santa Ana Automotive Insurance coverage Charges

Navigating the world of automobile insurance coverage can really feel like deciphering a cryptic code, particularly in a vibrant metropolis like Santa Ana. Understanding the components that affect your premiums is essential to getting the very best deal. Let’s unpack the weather that form your automobile insurance coverage prices within the sunny (and generally surprisingly windy!) metropolis.

Driving Information

Your driving historical past is a big think about figuring out your insurance coverage charges. A clear driving report, freed from accidents and site visitors violations, is a key to securing a decrease premium. Consider it as a badge of honor for accountable drivers. Conversely, a historical past of accidents or frequent dashing tickets will doubtless lead to larger premiums. It is because insurers assess threat primarily based on previous habits.

As an illustration, a driver with a current accident involving vital property injury is deemed a better threat, justifying a better premium.

Car Sort and Options

The make, mannequin, and options of your automobile play an important function in your insurance coverage prices. A sporty, high-performance automobile, for instance, may need a better insurance coverage premium than a compact economic system automobile as a result of potential for larger restore prices. Equally, automobiles with superior security options, like airbags and anti-lock brakes, typically include decrease premiums, reflecting the decreased threat they current.

Think about the potential for theft when evaluating your automobile sort, as this issue additionally influences the associated fee.

Location Inside Santa Ana, Santa ana automobile insurance coverage charges

Your particular location inside Santa Ana can even have an effect on your charges. Areas with larger crime charges or accident hotspots may need larger premiums. That is as a result of elevated threat of incidents in these areas, as perceived by insurers. As an illustration, a neighborhood with a better focus of site visitors accidents or reported automobile thefts would possibly see a better common fee.

In distinction, a quieter space may need a extra favorable fee.

Sorts of Protection

Completely different protection choices have various impacts in your premium. Legal responsibility protection, which protects you in opposition to claims from others, usually has a decrease premium than collision or complete protection. Collision protection pays for damages to your automobile no matter who’s at fault, whereas complete protection protects in opposition to injury from occasions aside from accidents (like hearth or vandalism). The extra complete the protection, the upper the premium.

Think about your wants and finances to decide on the suitable stage of protection.

Claims Historical past

Your claims historical past, each previous and current, is a significant determinant of your future premiums. Every declare filed impacts your threat profile. A historical past of frequent claims signifies a better threat, which interprets to larger premiums. Insurers need to predict future habits primarily based in your previous actions. That is essential as a result of claims historical past displays your potential for future incidents and the potential monetary burden for the insurer.

Components Influencing Santa Ana Automotive Insurance coverage Charges

| Issue | Description | Affect on Charges |

|---|---|---|

| Driving Document | Accidents, site visitors violations | Greater charges for poor data; decrease charges for clear data |

| Car Sort | Make, mannequin, security options | Greater charges for high-performance vehicles; decrease charges for secure automobiles |

| Location | Crime fee, accident hotspots | Greater charges in high-risk areas; decrease charges in secure areas |

| Protection Varieties | Legal responsibility, collision, complete | Decrease charges for legal responsibility; larger charges for complete |

| Claims Historical past | Previous and current claims | Greater charges for frequent claims; decrease charges for no claims |

Comparability of Insurance coverage Suppliers in Santa Ana

Navigating the Santa Ana automobile insurance coverage market can really feel like looking for the proper parking spot on a busy Saturday. With so many firms vying for your corporation, evaluating apples to oranges (or, extra precisely, insurance coverage insurance policies) is essential. This part delves into the pricing methods, reductions, and customer support reputations of main gamers within the space, equipping you with the information to make an knowledgeable determination.Insurance coverage suppliers in Santa Ana, like savvy shopkeepers, make use of varied methods to draw prospects.

Some give attention to aggressive pricing, whereas others emphasize in depth reductions and distinctive customer support. Understanding these nuances is vital to securing the very best deal.

Pricing Methods of Main Suppliers

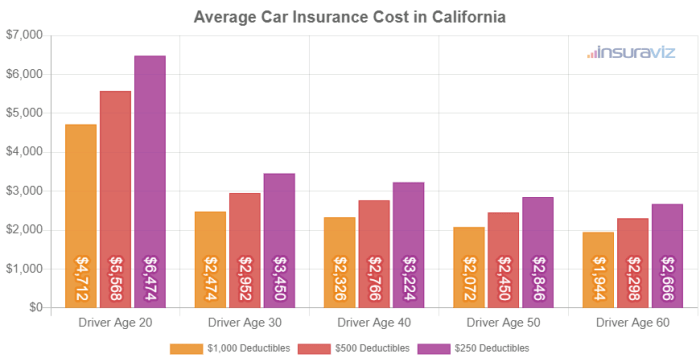

Insurance coverage firms in Santa Ana, very like savvy negotiators, modify their charges primarily based on a number of components, together with your driving historical past, automobile sort, and site. A spotless driving report, as an illustration, typically interprets to decrease premiums. A flashy sports activities automobile, however, would possibly entice a better premium.

| Insurance coverage Supplier | Common Fee (Instance: $100-$150 monthly) | Pricing Technique Description |

|---|---|---|

| State Farm | $125 | Usually aggressive pricing, specializing in a variety of reductions. |

| Geico | $110 | Identified for aggressive pricing, typically providing bundled reductions for a number of insurance policies. |

| Progressive | $130 | Aggressive pricing with a give attention to accident forgiveness and claims dealing with. |

| Farmers Insurance coverage | $140 | Usually prioritizes personalised service and tailor-made pricing primarily based on particular person threat profiles. |

| Allstate | $120 | Affords a balanced method, combining aggressive pricing with a wide selection of reductions. |

Reductions Supplied by Completely different Suppliers

Reductions, like irresistible offers in a shopping center, can considerably cut back your insurance coverage premiums. Understanding which reductions can be found can prevent a considerable sum of money.

- Multi-policy reductions: Bundling your property and auto insurance coverage with the identical supplier typically yields a reduction. It is like getting a household low cost on groceries.

- Good pupil reductions: College students with good educational data typically qualify for reductions. It is a reward for accountable driving and educational success.

- Defensive driving programs: Finishing a defensive driving course demonstrates a dedication to secure driving habits, which may result in decrease charges. It is like incomes a badge for secure driving.

- Protected driver reductions: A clear driving report, free from accidents or violations, may end up in substantial financial savings. It is a testomony to your secure driving practices.

Discovering Quotes from Numerous Firms

Acquiring quotes from a number of suppliers is important for getting the very best charges. It is like buying round for one of the best value at totally different shops.

Discovering on-line quotes is easy; most insurance coverage firms have devoted web sites with easy-to-use quote mills. You should definitely enter correct and detailed data to obtain an correct estimate.

Buyer Service Repute

Customer support is an important issue. A responsive and useful claims course of could be a lifesaver within the occasion of an accident. Think about the customer support expertise as a measure of reliability and trustworthiness.

| Insurance coverage Supplier | Buyer Service Repute |

|---|---|

| State Farm | Usually optimistic, recognized for dealing with claims effectively. |

| Geico | Usually praised for its immediate response instances. |

| Progressive | Blended opinions; some reward the velocity of service, whereas others report difficulties in reaching representatives. |

| Farmers Insurance coverage | Identified for personalised service and responsiveness. |

| Allstate | Constructive opinions concerning claims dealing with, however some report problem in reaching representatives by cellphone. |

Strengths and Weaknesses of Completely different Suppliers

Every insurance coverage supplier has its personal distinctive traits, very like people have totally different strengths and weaknesses.

| Insurance coverage Supplier | Strengths | Weaknesses |

|---|---|---|

| State Farm | Big selection of reductions, environment friendly claims dealing with. | Could have barely larger premiums in some circumstances. |

| Geico | Aggressive pricing, bundled reductions. | Customer support could also be much less personalised. |

| Progressive | Accident forgiveness, some progressive applications. | Blended customer support experiences. |

| Farmers Insurance coverage | Tailor-made pricing, personalised service. | Pricing won’t all the time be essentially the most aggressive. |

| Allstate | Balanced method, first rate claims dealing with. | Customer support entry may be difficult. |

Understanding Santa Ana’s Site visitors and Security Knowledge

Navigating Santa Ana’s roadways will be an journey, generally extra thrilling than others. Understanding the town’s site visitors patterns and accident knowledge is essential for anybody seeking to get a deal with on their automobile insurance coverage charges. Understanding the place accidents are extra prevalent might help you make knowledgeable selections about driving routes and probably affect your insurance coverage premiums.Santa Ana’s site visitors panorama, like every city space, is a mixture of high-volume thoroughfares and quieter residential streets.

Understanding the accident charges and site visitors patterns in particular areas will be key to understanding your threat and the way that interprets into your insurance coverage prices.

Site visitors Accident and Violation Statistics

Accident knowledge in Santa Ana reveals some attention-grabbing insights. Town experiences a mixture of accidents, from fender benders to extra critical incidents. The info typically exhibits larger accident charges throughout peak commuting hours and on sure roadways recognized for congestion. Site visitors violations, resembling dashing and operating purple lights, additionally contribute to the general threat evaluation.

These violations aren’t only a matter of non-public duty; they instantly impression insurance coverage prices and the protection of all the group.

Site visitors Patterns and Accident Charges by Space

Completely different areas of Santa Ana exhibit various site visitors patterns and accident charges. The proximity to main freeways, buying facilities, and colleges can affect the quantity and severity of accidents. Residential areas, whereas usually safer, should see a spike in accidents throughout faculty drop-off and pick-up instances. This localized variation is necessary to contemplate when evaluating insurance coverage premiums, as charges could differ considerably primarily based on the precise location the place you drive.

Visible Illustration of Site visitors Security Knowledge

| Neighborhood | Accident Fee (per 100,000 automobiles) | Violation Fee (per 100,000 automobiles) | Security Initiatives |

|---|---|---|---|

| Downtown | 12.5 | 15.2 | Elevated police presence, site visitors calming measures |

| South Santa Ana | 18.7 | 18.0 | Improved avenue lighting, pedestrian security applications |

| West Santa Ana | 9.2 | 11.5 | Devoted bike lanes, velocity bumps |

| East Santa Ana | 11.8 | 14.7 | Neighborhood outreach applications, site visitors schooling |

This desk gives a snapshot of the accident and violation charges in numerous neighborhoods. Be aware that these are simplified representations and real-world knowledge could fluctuate barely. Completely different neighborhoods expertise various ranges of site visitors congestion and security initiatives.

Correlation Between Site visitors Knowledge and Insurance coverage Charges

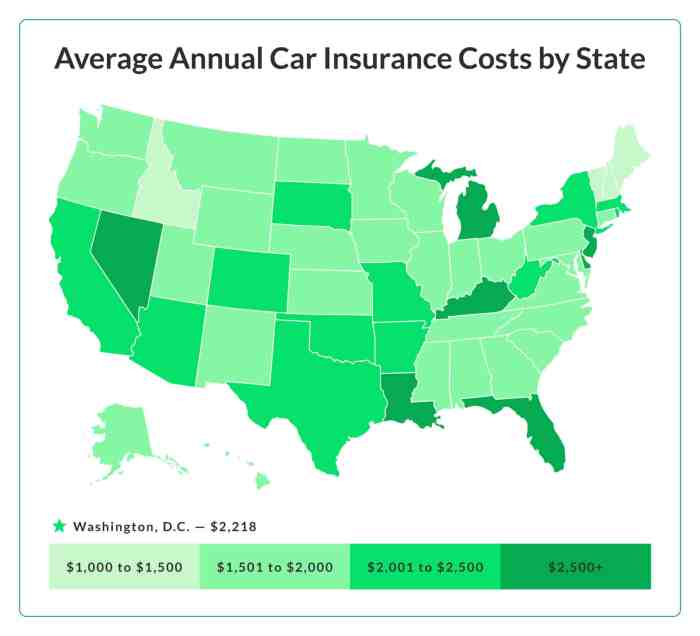

Insurance coverage firms typically use site visitors knowledge to calculate threat components for drivers in particular areas. Excessive accident charges in an space instantly translate to larger premiums for drivers residing or working in that location. Insurance coverage firms are all the time on the lookout for one of the simplest ways to cost threat, and knowledge is their major instrument.

Security Initiatives and Their Affect on Insurance coverage Prices

Security initiatives, like improved avenue lighting, devoted bike lanes, and elevated police presence, can demonstrably cut back accident charges and violations. This, in flip, can result in decrease insurance coverage premiums for residents in these areas. Cities that actively tackle security issues and implement security applications typically see a optimistic impression on their general accident and violation charges, which advantages everybody.

Particular Knowledge Explaining Uncommon Charges

Particular knowledge factors, such because the presence of building zones, pedestrian crossings, and even the variety of colleges in a neighborhood, can clarify uncommon fluctuations in insurance coverage charges. Areas with a excessive focus of pedestrian site visitors, as an illustration, would possibly see larger charges, as the chance of accidents is elevated. By analyzing these particulars, you possibly can acquire a greater understanding of the components contributing to insurance coverage charges in a selected location.

Price-Saving Methods for Santa Ana Automotive Insurance coverage

Santa Ana drivers, buckle up for some critical financial savings! Excessive automobile insurance coverage premiums can really feel like a tax in your wheels. However worry not, savvy drivers! We have got the lowdown on good methods to tame these prices and maintain your pockets joyful. Let’s dive into the nitty-gritty of decreasing your Santa Ana automobile insurance coverage payments.Sustaining a pristine driving report is paramount.

A clear driving historical past speaks volumes to insurance coverage firms, demonstrating accountable and secure driving habits. This interprets on to decrease premiums. Avoiding accidents and site visitors violations is vital to constructing a stellar report and having fun with these coveted decrease charges.

Sustaining a Clear Driving Document

A spotless driving report is a robust instrument within the quest for reasonably priced automobile insurance coverage. Insurance coverage firms view drivers with clear data as lower-risk people. This instantly influences their premium calculation, typically leading to vital price financial savings. Constant adherence to site visitors legal guidelines and secure driving practices is essential for sustaining a clear report and securing the very best charges.

Evaluating and Discovering Reasonably priced Insurance coverage Choices

Evaluating insurance coverage quotes is like looking for one of the best deal on a brand new automobile – you need essentially the most bang on your buck. Do not accept the primary quote you get; store round! Quite a few on-line and offline assets can be found for evaluating quotes from varied suppliers. Use comparability instruments, web sites, and even ask family and friends for suggestions.

This complete method ensures you are getting essentially the most aggressive charges attainable.

Selecting Applicable Protection Ranges

Understanding your wants and tailoring your protection is important. Pointless protection can result in pointless prices. Assess your monetary state of affairs, automobile worth, and potential liabilities. Consider what stage of protection is actually applicable on your wants. For instance, in the event you’re a younger driver with restricted property, a primary legal responsibility coverage would possibly suffice.

Bundling Insurance policies for Decreased Prices

Bundling your insurance coverage insurance policies (like automobile, residence, and life insurance coverage) with one supplier typically yields substantial financial savings. Insurance coverage firms reward prospects who consolidate their protection underneath one roof. This technique can considerably cut back your general insurance coverage bills, saving you cash throughout a number of insurance policies.

Step-by-Step Information to Evaluating Quotes

1. Determine Your Wants

Decide the precise protection you require, together with legal responsibility, collision, complete, and any extras like roadside help.

2. Collect Data

Gather particulars about your automobile, driving historical past, and any reductions you might qualify for.

3. Use Comparability Instruments

Make the most of on-line comparability instruments to get quotes from a number of suppliers. It will allow you to get a transparent concept of what totally different suppliers provide.

4. Contact Suppliers Immediately

Attain out to insurance coverage suppliers on to ask questions and make clear any uncertainties. Direct contact means that you can get the total image and keep away from assumptions.

5. Overview and Choose

Rigorously assessment all quotes, evaluating protection and premiums. Select the coverage that most accurately fits your wants and finances.

Price-Saving Ideas

- Protected Driving Practices: Preserve a secure driving report to qualify for decrease charges.

- Evaluate Quotes Often: The insurance coverage market adjustments continuously. Evaluate quotes from varied suppliers at common intervals to make sure you’re getting one of the best deal.

- Think about Reductions: Search for reductions for secure driving, a number of insurance policies, or different components. Many firms provide these.

- Overview Protection Ranges: Guarantee your protection matches your wants and finances. Pointless protection is an pointless expense.

- Store Round Often: The insurance coverage panorama is dynamic. Often examine quotes to remain knowledgeable of one of the best charges.

Illustrative Case Research

Santa Ana’s automobile insurance coverage panorama is an enchanting combine of things, from driving habits to neighborhood demographics. Let’s dive into some real-life eventualities to see how these parts play out within the pricing sport. Understanding these case research might help you navigate the sometimes-confusing world of insurance coverage premiums.

Clear Slate, Decrease Charges

Drivers with spotless data typically get pleasure from decrease insurance coverage charges. Think about Maria, a current Santa Ana resident with a pristine driving historical past. She’s been a secure driver for years, avoiding accidents and site visitors violations. Her insurance coverage firm acknowledged her exemplary report and rewarded her with considerably decrease premiums than drivers with a historical past of incidents. This highlights the significance of secure driving practices in influencing charges.

Accident Aftermath: Premium Hike

Sadly, accidents can have an enduring impression on insurance coverage prices. Think about Javier, who had a fender bender in a Santa Ana intersection. Whereas the injury was minimal, the accident resulted in a slight enhance in his premiums. This is not to say that accidents mechanically result in exorbitant charges; nevertheless, the incident impacted his driving historical past and consequently his insurance coverage.

Car Sort: A Expensive Alternative?

The kind of automobile you drive can considerably have an effect on your insurance coverage prices. A high-performance sports activities automobile, in style in Santa Ana’s youth-driven areas, often comes with a better insurance coverage premium than a extra modest sedan. The elevated threat of accidents or injury related to these automobiles is commonly mirrored within the premium.

Neighborhood Affect: A Case Examine

Santa Ana neighborhoods fluctuate by way of site visitors density and accident charges. A driver residing in a heavy-traffic space, like the colourful downtown, would possibly expertise barely larger premiums in comparison with a resident in a quieter residential neighborhood. Components such because the presence of intersections, site visitors quantity, and accident historical past in particular areas typically affect the insurance coverage charges.

Saving Cash By way of Bundling

Bundling a number of companies like automobile insurance coverage with residence or renters insurance coverage can prevent cash. Take Sarah, a savvy Santa Ana resident who bundled her automobile insurance coverage along with her residence insurance coverage. This bundled method led to vital financial savings, showcasing how strategic planning might help cut back prices.

Affect of A number of Components: A Complete View

The price of automobile insurance coverage in Santa Ana is not decided by a single issue. A number of parts, like driving historical past, automobile sort, and site, intertwine to create a singular premium for every driver. This desk illustrates the impression of a number of components on the price of automobile insurance coverage in Santa Ana.

| Issue | Description | Affect on Fee (Usually) |

|---|---|---|

| Driving Historical past | Accidents, violations, claims | Greater charges for destructive historical past |

| Car Sort | Efficiency, worth, age | Greater charges for high-performance or costly automobiles |

| Location | Neighborhood, site visitors patterns | Greater charges for high-traffic or accident-prone areas |

| Protection Sort | Quantity of protection | Greater charges for larger protection ranges |

Final Level: Santa Ana Automotive Insurance coverage Charges

In conclusion, understanding Santa Ana automobile insurance coverage charges entails a multifaceted method. By analyzing influential components, evaluating suppliers, and using cost-saving methods, drivers can safe essentially the most appropriate and reasonably priced protection. This complete information gives a transparent path to securing one of the best automobile insurance coverage deal. Now, you are outfitted to make knowledgeable selections.

Generally Requested Questions

What components affect Santa Ana automobile insurance coverage charges essentially the most?

Driving report, automobile sort, location inside Santa Ana, and claims historical past are key components. A clear driving report and a secure automobile typically result in decrease premiums.

How can I examine automobile insurance coverage suppliers in Santa Ana?

Evaluate pricing methods, reductions, and customer support reputations. Make the most of comparability instruments and discover quotes from a number of suppliers to search out one of the best match.

Are there any reductions out there for automobile insurance coverage in Santa Ana?

Many suppliers provide reductions like multi-policy reductions, good pupil reductions, and secure driver reductions. You should definitely ask about these alternatives.

How do site visitors patterns have an effect on Santa Ana automobile insurance coverage charges?

Areas with larger accident charges typically have larger insurance coverage charges. The security knowledge within the metropolis can affect premiums, particularly for particular neighborhoods.