Automotive insurance coverage charges Pittsburgh PA: navigating the complexities of protection within the Metal Metropolis. From the bustling streets of downtown to the quieter neighborhoods, the price of defending your car varies considerably. Elements like your driving file, car sort, and even your location inside the metropolis play a pivotal function in shaping your premium. Understanding these nuances is essential for making knowledgeable choices about your protection.

This complete information delves into the intricacies of automobile insurance coverage charges in Pittsburgh, PA, evaluating native averages to nationwide traits, highlighting variations between insurance coverage suppliers, and offering actionable tricks to decrease prices. We’ll additionally discover particular issues for various car sorts, from traditional vehicles to electrical automobiles, and the way these components contribute to the general insurance coverage panorama.

Elements Affecting Automotive Insurance coverage Charges in Pittsburgh, PA

Automotive insurance coverage charges in Pittsburgh, PA, are influenced by a fancy interaction of things, usually differing from nationwide averages. Understanding these components is essential for Pittsburgh drivers in search of to handle their insurance coverage prices successfully. This evaluation delves into the important thing determinants of premiums, offering insights into learn how to doubtlessly decrease your charges.Pittsburgh’s automobile insurance coverage panorama is formed by components distinctive to town, alongside nationwide traits.

Elements like native visitors patterns, accident frequency, and particular car sorts play a big function in figuring out charges. This in-depth look will uncover the important thing elements impacting your insurance coverage prices, out of your driving file to the make and mannequin of your automobile.

Driving Historical past

Driving historical past considerably impacts automobile insurance coverage premiums throughout the nation and in Pittsburgh. Accidents, visitors violations, and claims historical past all contribute to the calculation of threat profiles. A clear driving file, freed from accidents and violations, usually results in decrease premiums. Conversely, drivers with a historical past of accidents or violations face greater charges. This displays the insurer’s evaluation of threat, as a driver with a poor driving file is statistically extra prone to trigger an accident and file a declare.

This distinction in threat evaluation instantly interprets into differing premiums.

Automobile Kind and Mannequin

The sort and mannequin of your car are additionally main components influencing your insurance coverage premiums. Sure automobiles, as a result of their inherent design or security options, are thought-about greater or decrease threat. For instance, sports activities vehicles or high-performance automobiles usually have greater premiums as a result of their elevated potential for accidents and injury. Conversely, automobiles with superior security options and confirmed reliability might qualify for discounted charges.

Insurers assess the restore prices and potential for injury to the car, in addition to the everyday threat related to the car mannequin. This calculation helps decide the premium quantity.

Age, Gender, and Driving Expertise

Age, gender, and driving expertise considerably affect insurance coverage charges. Youthful drivers, particularly, usually face greater premiums in comparison with older drivers. That is as a result of greater threat related to inexperience. Moreover, there could also be gender-based variations in charges, although these have gotten much less prevalent. An extended driving historical past usually correlates with a decrease threat profile, leading to doubtlessly decrease premiums.

| Attribute | Description | Typical Price Affect |

|---|---|---|

| Age (Younger Drivers) | Drivers below 25 sometimes have greater premiums as a result of greater accident threat | Greater premiums |

| Age (Older Drivers) | Drivers over 65 sometimes have decrease premiums, as a result of a decrease accident threat. | Decrease premiums |

| Gender | Traditionally, some gender-based variations exist however these have gotten much less pronounced. | Potential price distinction, however narrowing |

| Driving Expertise | Drivers with longer driving histories sometimes have decrease premiums. | Decrease premiums |

Widespread Misconceptions

There are a number of widespread misconceptions about automobile insurance coverage pricing in Pittsburgh. One false impression is that charges are solely based mostly on location. Whereas location does play a task, it is not the only real issue. One other false impression is that charges are static. Insurance coverage corporations frequently regulate charges based mostly on threat components, making them dynamic.

Moreover, some imagine {that a} single accident could have a long-lasting, unchanging impact on charges. Whereas accidents improve premiums, they don’t essentially keep elevated indefinitely.

Comparability with Nationwide Averages

Automotive insurance coverage charges in Pittsburgh usually differ from nationwide averages. Elements like native accident charges and driving habits affect premiums within the metropolis. For instance, if Pittsburgh has the next price of accidents involving particular car sorts, insurance coverage corporations might regulate premiums for these sorts in Pittsburgh. These variations replicate the distinctive threat profile of the Pittsburgh driving inhabitants.

Insurance coverage Firm Variations in Pittsburgh

Navigating the automobile insurance coverage panorama in Pittsburgh can really feel like a maze. Totally different insurance coverage suppliers make use of numerous pricing methods and provide various protection choices, making it essential to grasp the nuances of every. This comparability will allow you to perceive the strengths and weaknesses of main gamers out there, permitting you to make an knowledgeable resolution tailor-made to your particular wants.Understanding the varied choices from totally different insurance coverage corporations is important.

Every supplier in Pittsburgh has its personal strategy to calculating threat, impacting premiums and out there reductions. This evaluation will make clear the important thing variations, enabling you to match protection and discover the most effective match on your car, driving file, and monetary scenario.

Pricing Methods of Main Suppliers

Totally different insurance coverage corporations in Pittsburgh make the most of various pricing fashions. Some suppliers may emphasize complete protection choices, whereas others prioritize decrease premiums. For instance, one firm may closely weigh a driver’s accident historical past, whereas one other focuses on the car’s make and mannequin. Understanding these methods is significant find the suitable match on your wants.

Protection Choices Supplied by Totally different Corporations

Protection choices can differ considerably between suppliers. Some corporations may prioritize complete protection, whereas others may lean in the direction of liability-only plans. The extent of safety towards accidents, injury, and theft is a important issue. As an illustration, one firm may provide greater payout limits for collision injury, whereas one other may provide a extra intensive record of coated perils. It’s essential fastidiously contemplate the extent of protection every plan gives.

Comparability of Prime Three Suppliers in Pittsburgh

| Insurance coverage Supplier | Strengths | Weaknesses |

|---|---|---|

| Firm A | Aggressive charges, notably for drivers with good data. In depth community of restore outlets. | Restricted protection choices for particular automobiles or high-risk drivers. Customer support may very well be improved in sure areas. |

| Firm B | Sturdy emphasis on accident forgiveness and a variety of reductions. Dependable buyer help. | Premiums is likely to be greater for drivers with a less-than-perfect driving historical past. Restricted protection for particular car sorts. |

| Firm C | Wonderful customer support, versatile fee choices. Good protection choices for particular car fashions. | Greater premiums in comparison with different suppliers. Restricted reductions for accident-free drivers. |

This desk gives a primary comparability of the highest three insurance coverage suppliers in Pittsburgh, highlighting their strengths and weaknesses. It is essential to analysis every supplier’s particular insurance policies and circumstances.

Coverage Phrases and Circumstances

Coverage phrases and circumstances differ broadly. Reviewing the positive print is essential. Elements like deductibles, exclusions, and protection limits can affect your monetary duty within the occasion of a declare. It’s important to grasp these particulars earlier than signing up for a coverage. Important variations might embody how they deal with claims or the kinds of automobiles they cowl.

Threat Evaluation Strategies in Pittsburgh

Insurance coverage corporations use numerous strategies to evaluate threat in Pittsburgh. These strategies contemplate components like the motive force’s age, driving historical past, location, car sort, and even the neighborhood. For instance, areas with the next focus of accidents may result in greater premiums for residents in these areas. This threat evaluation is significant in setting applicable premiums. Subtle algorithms analyze information to foretell potential claims.

Low cost Variations Amongst Insurance coverage Corporations

Reductions provided by totally different insurance coverage corporations differ. Reductions is likely to be based mostly on components such nearly as good driving data, anti-theft units, or sure kinds of automobiles. As an illustration, some corporations provide substantial reductions for protected drivers, whereas others might emphasize reductions for college kids or those that preserve good credit score. An in depth evaluate of the reductions provided by every supplier can assist you lower your expenses.

Native vs. Nationwide Insurance coverage Traits

Pittsburgh’s automobile insurance coverage panorama differs considerably from the nationwide common. Elements like native visitors patterns, accident sorts, and demographic make-up contribute to premiums that deviate from nationwide traits. Understanding these nuances is essential for each residents and insurance coverage suppliers in search of correct pricing fashions.Nationwide averages usually masks the particular dangers drivers in Pittsburgh face. For instance, whereas nationwide averages may point out a basic pattern of rising premiums as a result of inflation and restore prices, Pittsburgh’s distinctive traits may result in a steeper improve in particular areas as a result of components like climate circumstances or the prevalence of explicit accident sorts.

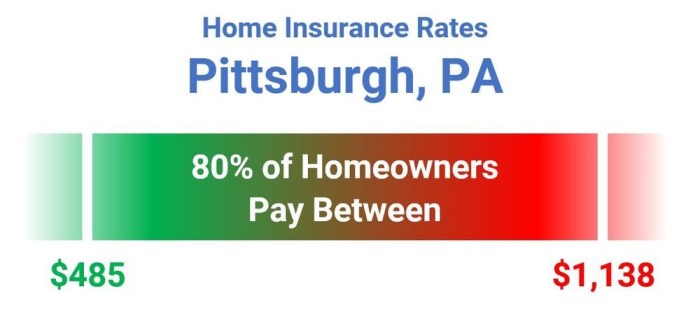

Common Automotive Insurance coverage Charges in Pittsburgh vs. Nationwide

Pittsburgh’s common automobile insurance coverage charges sometimes exceed the nationwide common. This distinction arises from a mix of localized threat components. Whereas exact figures differ by insurer and driver profile, analysis constantly exhibits the next value of insurance coverage in Pittsburgh in comparison with nationwide benchmarks.

Kinds of Dangers Confronted by Pittsburgh Drivers

Drivers in Pittsburgh face a definite set of dangers in comparison with drivers in different areas. Pittsburgh’s hilly terrain, frequent inclement climate, and dense city setting contribute to the next threat of accidents. The town’s older infrastructure and restricted visibility in sure areas improve the probability of collisions and accidents. The prevalence of particular accident sorts, resembling these involving parked automobiles or pedestrians crossing busy streets, can also be noteworthy and considerably impacts declare payouts.

Traits in Automotive Insurance coverage Claims and Payouts in Pittsburgh

Pittsburgh experiences distinctive traits in automobile insurance coverage claims and payouts. Research point out the next frequency of claims associated to weather-related accidents, particularly throughout winter months. The town’s dense inhabitants and pedestrian exercise contribute to the next price of accidents involving pedestrians and cyclists. Moreover, town’s older car inhabitants may contribute to a larger frequency of claims for important car injury.

Pittsburgh’s Accident Kind Prevalence

| Accident Kind | Frequency | Description |

|---|---|---|

| Rear-end collisions | Excessive | Widespread in congested metropolis visitors, usually exacerbated by lowered visibility or poor climate. |

| Angle collisions | Excessive | Continuously happen at intersections or in parking heaps, particularly within the metropolis’s hilly areas. |

| Pedestrian accidents | Reasonable | Widespread in areas with excessive pedestrian visitors and crosswalks. |

| Automobile-parked car collisions | Reasonable | Frequent in parking heaps and residential streets, generally associated to insufficient visibility or driver error. |

| Climate-related accidents | Excessive (particularly winter) | Ice, snow, and rain regularly result in elevated accidents, notably within the hilly areas of town. |

Knowledge on accident sorts might differ by insurance coverage supplier.

Affect of Native Site visitors Legal guidelines and Rules on Insurance coverage Premiums

Pittsburgh’s particular visitors legal guidelines and laws, together with these associated to hurry limits, parking restrictions, and pedestrian security, instantly affect insurance coverage premiums. Stricter enforcement of those legal guidelines might result in decrease premiums for compliant drivers, whereas violations may end up in greater premiums. For instance, a metropolis with strict velocity limits and elevated police presence for visitors enforcement may see a decrease declare price and, consequently, decrease insurance coverage premiums.

Function of Native Demographics on Automotive Insurance coverage Charges

The demographics of Pittsburgh, together with the age distribution of drivers and the proportion of younger drivers, affect insurance coverage charges. The next focus of younger drivers, usually related to the next threat profile, might drive up premiums for your entire inhabitants. The presence of sure ethnic teams or socioeconomic components may also affect the danger evaluation fashions utilized by insurance coverage corporations.

These components are thought-about by insurance coverage corporations alongside the claims information, resulting in changes in pricing.

Suggestions for Lowering Automotive Insurance coverage Prices in Pittsburgh

Navigating the automobile insurance coverage panorama in Pittsburgh, PA, can really feel like a maze. Understanding the components influencing your charges and taking proactive steps to decrease your premiums is essential. This part affords sensible methods that can assist you management your automobile insurance coverage prices within the metropolis.Efficient methods for decreasing automobile insurance coverage premiums in Pittsburgh contain a mix of sensible decisions and accountable driving habits.

By adopting these practices, you may doubtlessly decrease your month-to-month funds and lower your expenses over the long run.

Sustaining a Clear Driving File

A spotless driving file is paramount for securing favorable automobile insurance coverage charges. Accidents and violations instantly affect your insurance coverage premiums. Every incident, from rushing tickets to at-fault accidents, can result in greater charges. Proactively avoiding visitors violations and sustaining protected driving practices is a cornerstone of decreasing insurance coverage prices. This contains adhering to hurry limits, following visitors legal guidelines, and paying attention on the street.

Usually reviewing your driving file and promptly addressing any points is essential for sustaining a clear file and securing decrease premiums.

Using Out there Reductions

Many insurance coverage suppliers provide reductions tailor-made to particular conditions. Benefiting from these reductions can considerably cut back your premiums. Reductions might be categorized based mostly on components resembling driver traits, car options, and way of life decisions.

- Defensive Driving Programs: Finishing a defensive driving course demonstrates a dedication to protected driving practices. This usually qualifies for a reduction in your premiums.

- Multi-Coverage Reductions: Bundling your automobile insurance coverage with different insurance policies, like dwelling or renters insurance coverage, may end up in substantial financial savings. This technique leverages the insurer’s economies of scale.

- Secure Driver Rewards Applications: Many insurers provide rewards applications for protected driving habits. By avoiding accidents and sustaining a clear file, you may accumulate factors or credit for decrease premiums.

- Anti-theft Units: Putting in anti-theft units in your car can qualify you for reductions, reflecting the lowered threat of theft.

- Good Pupil Reductions: If you happen to’re a scholar, examine in case your insurer affords a reduction particularly for scholar drivers. These reductions acknowledge the decrease threat profile of younger, accountable drivers.

The Worth of Bundling Insurance coverage Insurance policies, Automotive insurance coverage charges pittsburgh pa

Bundling your automobile insurance coverage with different insurance policies, like dwelling or renters insurance coverage, can yield substantial financial savings. This technique leverages the insurer’s economies of scale. By inserting all of your insurance coverage wants with the identical firm, you usually obtain a bundled low cost. For instance, a household who insures a number of automobiles, a house, and doubtlessly a ship, can cut back their total insurance coverage prices considerably.

Complete Protection Issues

Complete protection protects your car from damages past collision. This contains damages from vandalism, climate occasions, or theft. Not having complete protection can expose you to important monetary dangers in case your automobile is broken or stolen. Take into account the potential prices related to not having complete protection, resembling the complete substitute worth of your car. As an illustration, a complete declare would cowl damages from hail or a damaged windshield, whereas a collision declare covers damages from a direct affect with one other car.

In some instances, complete protection is required to take care of legal responsibility protection.

Widespread Reductions and Qualification

| Low cost | Description | Qualification |

|---|---|---|

| Defensive Driving Course | Completion of a defensive driving course. | Completion of a course accredited by the insurer. |

| Multi-Coverage Low cost | Low cost for a number of insurance coverage insurance policies with the identical firm. | Having a couple of coverage with the identical insurer. |

| Good Pupil Low cost | Reductions for college kids. | Being a scholar enrolled in a acknowledged academic establishment. |

| Anti-theft Gadget Low cost | Reductions for automobiles with anti-theft units. | Putting in and registering accredited anti-theft units. |

| Secure Driver Rewards Program | Reductions for protected driving habits. | Sustaining a clear driving file and avoiding accidents. |

Particular Issues for Particular Automobile Sorts

Automotive insurance coverage charges in Pittsburgh, PA, aren’t a one-size-fits-all state of affairs. Totally different car sorts current distinctive threat profiles, influencing premiums. Understanding these variations is essential for securing essentially the most appropriate protection on the best value. Elements like car age, security options, and potential for injury all play a big function.Particular traits of assorted car sorts, from sports activities vehicles to electrical automobiles, instantly have an effect on insurance coverage threat assessments.

Insurers contemplate the probability of accidents, restore prices, and potential theft when figuring out premiums. The inclusion of security options, resembling airbags and anti-lock brakes, usually reduces insurance coverage prices, whereas sure modifications can improve them.

Sports activities Automobiles

Sports activities vehicles, recognized for his or her efficiency and sometimes greater speeds, sometimes appeal to greater insurance coverage premiums than commonplace automobiles. The elevated potential for accidents and the price of repairs for injury to high-performance elements contribute to this. Insurance coverage corporations consider the car’s make, mannequin, and particular options when calculating charges.

Vehicles

Vehicles, notably bigger fashions, face greater insurance coverage premiums as a result of their elevated dimension and weight. The chance of accidents involving vehicles is usually greater, and restore prices for injury to vehicles might be considerably greater than for passenger vehicles. Insurance coverage suppliers contemplate components such because the truck’s payload capability and the motive force’s expertise when assessing premiums.

Bikes

Bikes have considerably greater insurance coverage premiums than vehicles, usually as a result of an absence of passenger safety and elevated vulnerability to accidents. The shortage of a passenger compartment, and the rider’s publicity, means greater threat for the insurer. Insurance coverage charges usually rely upon the bike’s sort, its options, and the rider’s expertise and security file.

Electrical Autos (EVs)

Electrical automobiles (EVs) are a comparatively new class, and insurance coverage charges are nonetheless creating in Pittsburgh. The comparatively decrease restore prices for EVs, and their distinctive element vulnerabilities, have an effect on premiums. Insurers are nonetheless creating a complete understanding of the particular dangers related to EVs, resulting in various premiums throughout totally different corporations. Insurance coverage suppliers contemplate components such because the car’s battery know-how and charging infrastructure when evaluating the danger.

Traditional Automobiles

Traditional vehicles, with their usually greater worth and doubtlessly decrease security options, can have a fancy affect on insurance coverage premiums. The worth of the automobile, and the potential for theft, impacts insurance coverage prices. The chance of harm throughout transportation or upkeep additionally contributes to greater premiums. Insurers usually require particular endorsements or greater deductibles for traditional vehicles to account for these distinctive dangers.

In comparison with newer fashions, traditional vehicles regularly command greater premiums, as a result of each their greater worth and potential for injury.

Automobile Security Options

Automobile security options considerably affect insurance coverage premiums. Superior driver-assistance techniques (ADAS) and security applied sciences like airbags, anti-lock brakes, and digital stability management usually lead to decrease premiums. The presence and effectiveness of those security options sign a decrease threat of accidents to the insurance coverage firm. Insurance coverage corporations use security rankings from unbiased organizations just like the Insurance coverage Institute for Freeway Security (IIHS) to evaluate the general security of a car.

Aftermarket Modifications

Aftermarket modifications can affect insurance coverage premiums, each positively and negatively. Efficiency modifications, like high-performance exhaust techniques or tuned engines, can improve the probability of accidents and doubtlessly result in greater premiums. Modifications can have an effect on a car’s dealing with, doubtlessly rising the danger to the insurer. Modifications that enhance security, resembling upgraded brakes or suspension techniques, may result in decrease premiums.

Typical Insurance coverage Prices Desk

| Automobile Kind | Typical Insurance coverage Prices (Estimated) |

|---|---|

| Sports activities Automobiles | Greater than common |

| Vehicles (Giant) | Greater than common |

| Bikes | Considerably greater |

| Electrical Autos | Doubtlessly decrease or greater, relying on the car and insurer |

| Traditional Automobiles | Greater than common |

| Commonplace Passenger Automobiles | Common |

Be aware: This desk gives estimated prices and should differ based mostly on particular car options, driver profiles, and insurance coverage firm insurance policies.

Extra Elements Influencing Automotive Insurance coverage Prices in Pittsburgh

Pittsburgh’s automobile insurance coverage panorama is multifaceted, influenced by components past basic demographics. Understanding these nuanced components can assist residents navigate the insurance coverage market and doubtlessly safe extra favorable charges. These further issues, alongside location, car sort, and protection decisions, paint a clearer image of the general value of insuring a car within the metropolis.

Affect of Location Inside Pittsburgh

Pittsburgh’s various neighborhoods contribute to various insurance coverage premiums. Areas with greater concentrations of reported accidents or theft expertise correspondingly greater insurance coverage prices. That is usually as a result of elevated threat related to these particular areas. As an illustration, neighborhoods with the next density of high-value automobiles may appeal to extra consideration from thieves, resulting in greater insurance coverage premiums.

Function of Automotive Theft Charges and Statistics in Pittsburgh

Automotive theft charges in Pittsburgh, like every metropolis, considerably affect insurance coverage prices. Greater theft charges in particular areas or throughout town translate into greater premiums for residents in these areas. Insurance coverage corporations use statistical information to evaluate threat and regulate premiums accordingly. For instance, if a selected neighborhood constantly sees a surge in car thefts, the insurance coverage corporations might improve premiums for drivers residing there to replicate the elevated threat.

Significance of Contemplating Automotive Protection and Legal responsibility Protection

Choosing the proper protection sorts and ranges of legal responsibility protection is essential for efficient value administration. Complete protection, which protects towards injury past collisions, usually comes at the next premium however affords larger monetary safety. Equally, the extent of legal responsibility protection chosen instantly impacts the premiums. The next legal responsibility protection restrict sometimes interprets to the next premium, reflecting the larger monetary duty.

Particular Native Legal guidelines and Rules

Pittsburgh, like different municipalities, has particular laws that affect insurance coverage. For instance, obligatory minimal legal responsibility insurance coverage necessities affect the prices of protection choices. The presence of particular visitors legal guidelines or ordinances that instantly have an effect on driving security, or native laws regarding sure kinds of automobiles, may additionally issue into insurance coverage premiums.

Comparability of Insurance coverage Prices in Totally different Neighborhoods

Sadly, exact neighborhood-specific insurance coverage value comparisons should not available. Whereas insurance coverage corporations contemplate neighborhood information, they do not publicly launch this breakdown. The price of insurance coverage varies relying on components like car sort, driver profile, and the particular coverage chosen. This info is proprietary and used for inside threat evaluation and pricing methods.

Affect of Climate Circumstances and Driving Circumstances on Insurance coverage Premiums

Pittsburgh’s climate patterns, characterised by harsh winters and generally heavy snowfall, can have an effect on insurance coverage prices. These circumstances can improve the danger of accidents and injury to automobiles. Moreover, components resembling icy roads or heavy rain, that are frequent within the area, can improve the probability of accidents, thus driving up insurance coverage premiums. Drivers in areas liable to such climate circumstances might face barely greater premiums in comparison with these in areas with extra secure climate patterns.

Conclusive Ideas

In conclusion, automobile insurance coverage charges in Pittsburgh, PA, are a multifaceted challenge influenced by a large number of things. Out of your driving historical past to your neighborhood, and from the car you drive to the insurance coverage supplier you select, quite a few variables affect the ultimate premium. By understanding these components, you may make knowledgeable decisions that not solely defend your belongings but in addition decrease your bills.

Finally, accountable planning and a deep understanding of the Pittsburgh insurance coverage market are key to securing the very best protection on the best value.

FAQ Abstract: Automotive Insurance coverage Charges Pittsburgh Pa

What are the commonest reductions out there for automobile insurance coverage in Pittsburgh?

Widespread reductions embody these for good scholar drivers, protected driving applications, and multi-policy reductions. Verify with particular person suppliers for particular particulars and eligibility necessities.

How does my driving file have an effect on my insurance coverage charges in Pittsburgh?

A clear driving file is important for decrease premiums. Accidents and violations considerably improve your charges. The severity and frequency of infractions instantly correlate to the magnitude of the premium improve.

Do electrical automobiles have totally different insurance coverage charges than conventional automobiles in Pittsburgh?

Electrical automobiles might have barely decrease insurance coverage premiums than conventional automobiles, usually attributed to their usually decrease threat of accidents. Nonetheless, components like theft and particular protection wants can affect these variations.

How does location inside Pittsburgh have an effect on my automobile insurance coverage charges?

Neighborhoods with greater crime charges, notably these with extra automobile thefts, will often have greater insurance coverage premiums in comparison with these with decrease crime charges. Location-specific components like visitors density and accident frequency additionally play a component.