Low-cost automobile insurance coverage in cell al – Low-cost automobile insurance coverage in Cell, AL is essential for drivers on this space. Discovering the fitting protection at a aggressive value requires cautious comparability. This information explores the Cell, AL automobile insurance coverage market, analyzing elements that have an effect on premiums, evaluating corporations, and offering methods for locating reasonably priced choices.

From understanding totally different protection sorts to figuring out potential reductions, this complete information will enable you navigate the complexities of automobile insurance coverage in Cell, AL and safe the very best charges. We’ll additionally spotlight frequent pitfalls to keep away from.

Introduction to Low-cost Automotive Insurance coverage in Cell, AL

Cell, AL, is a metropolis with a vibrant automobile tradition, however discovering reasonably priced automobile insurance coverage can really feel like navigating a maze. The price of residing and driving habits within the space play a big position in shaping insurance coverage charges. Understanding these elements and evaluating quotes is vital to securing a deal that matches your funds.The automobile insurance coverage market in Cell, AL, is aggressive, with numerous suppliers vying for purchasers.

Nonetheless, charges range considerably relying on a number of key elements. Elements like your driving report, automobile sort, and site all contribute to the ultimate value. It is essential to buy round to seek out the most effective deal.

Elements Affecting Automotive Insurance coverage Charges in Cell, AL, Low-cost automobile insurance coverage in cell al

A number of elements affect your automobile insurance coverage premium in Cell, AL. These elements usually intertwine and may considerably affect your prices. Driving report is a serious consideration, with accidents and site visitors violations resulting in increased premiums. Your automobile sort and mannequin additionally play a task. Sports activities vehicles and high-performance automobiles often include increased premiums than extra frequent fashions.

Location inside Cell, AL, can have an effect on your charge as nicely. Areas with increased crime charges or increased accident frequency usually have increased insurance coverage prices.

Evaluating Quotes for Reasonably priced Insurance coverage

Evaluating automobile insurance coverage quotes is important for locating the very best value. A number of quotes from totally different suppliers mean you can see the variations in protection and premiums. Utilizing on-line comparability instruments can streamline this course of, saving you effort and time. This method allows you to simply evaluate protection choices and charges, making it simpler to decide on essentially the most appropriate plan in your wants.

Varieties of Automotive Insurance coverage Out there in Cell, AL

Varied varieties of automobile insurance coverage can be found in Cell, AL, every providing totally different ranges of protection. Legal responsibility insurance coverage is a basic sort of protection that protects you in opposition to claims from others in case of an accident. Collision protection pays for damages to your automobile if it is concerned in an accident, no matter who’s at fault. Complete protection safeguards your automobile in opposition to damages from occasions aside from collisions, like vandalism or theft.

Understanding these variations helps you choose the most effective protection in your particular person circumstances.

Comparability of Premiums for Totally different Protection Ranges

| Protection Stage | Description | Estimated Premium (Instance – Cell, AL) |

|---|---|---|

| Legal responsibility Solely | Protects you from claims from others. | $600-$1200 yearly |

| Legal responsibility + Collision | Protects you from claims and your automobile in collisions. | $800-$1500 yearly |

| Legal responsibility + Collision + Complete | Protects you from claims, your automobile in collisions, and different damages. | $1000-$1800 yearly |

Word: These are estimated premiums and should range considerably based mostly on particular person elements. Seek the advice of with a supplier for personalised quotes.

Figuring out Elements Influencing Insurance coverage Prices

Yo Cell, AL of us! Getting low-cost automobile insurance coverage ain’t rocket science, however understanding the elements that form your charges is vital. Realizing what influences your premium will help you discover the most effective offers. Let’s dive into the nitty-gritty!

Driving Document Influence on Premiums

Your driving historical past is a significant component in your insurance coverage price. A clear report, that means no accidents or tickets, often lands you a decrease premium. Consider it like this: in case you’re a accountable driver, insurance coverage corporations see much less danger and are pleased to give you a greater deal. Conversely, accidents or violations like rushing tickets or DUIs dramatically improve your charges.

It is a simple equation: safer drivers = cheaper insurance coverage.

Car Kind and Age Affecting Insurance coverage Prices

The kind of automobile you drive and its age performs an enormous position in your premium. Sports activities vehicles, for instance, usually have increased premiums in comparison with sedans, as a result of they’re thought-about extra dangerous to insure. Equally, older automobiles, particularly these with fewer security options, often price extra to insure than newer ones. Insurance coverage corporations contemplate the automobile’s make, mannequin, and security rankings when figuring out your premium.

Location inside Cell, AL, and Premiums

The place you reside in Cell, AL, issues. Areas with increased crime charges or extra accidents may need increased insurance coverage premiums. It is because insurance coverage corporations assess danger based mostly on the realm’s accident statistics. For example, in case your neighborhood has a better incidence of automobile theft, your premium may mirror that.

Driver Demographics and Insurance coverage Charges

Your age, gender, and even your occupation can have an effect on your insurance coverage charges. Youthful drivers are sometimes seen as increased danger, resulting in increased premiums. It is because they’ve much less driving expertise and a better chance of accidents. Equally, sure professions, like supply drivers, might face increased charges. Insurance coverage corporations have a look at these elements to find out the chance of a declare.

Claims Historical past and Insurance coverage Premiums

A historical past of claims, whether or not minor or main, can considerably improve your insurance coverage charges. Every declare filed provides to your danger profile within the eyes of the insurance coverage firm. They see that as an indication of potential future issues. So, if in case you have a historical past of submitting claims, anticipate your premiums to be increased than somebody with a clear report.

Elements Influencing Insurance coverage Premiums

| Issue | Influence on Premium |

|---|---|

| Driving Document (Accidents/Tickets) | Larger danger = Larger premium |

| Car Kind (Sports activities automobile vs Sedan) | Larger danger = Larger premium |

| Car Age (Older vs Newer) | Older automobiles = Larger premium |

| Location in Cell, AL | Larger crime/accident areas = Larger premium |

| Driver Demographics (Age, Gender, Career) | Larger danger profile = Larger premium |

| Claims Historical past | Claims = Larger premium |

Evaluating Insurance coverage Firms in Cell, AL

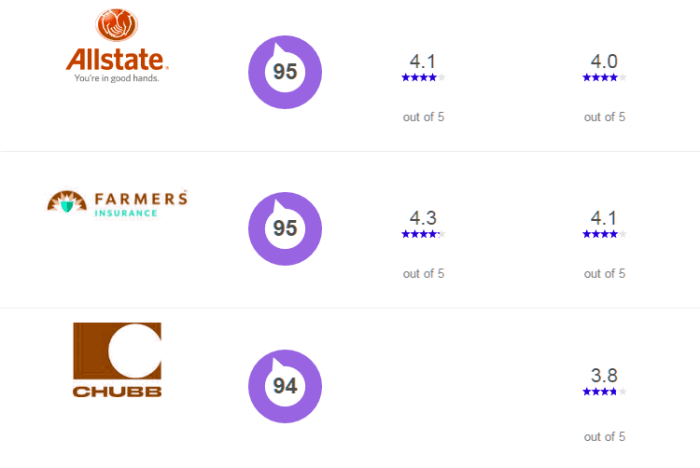

Snaggin’ the most cost effective automobile insurance coverage in Cell, AL can really feel like a treasure hunt. However do not sweat it! Realizing which corporations supply the most effective offers and repair is vital. We’re breaking down the foremost gamers within the Cell insurance coverage scene that will help you discover the proper match in your pockets and your peace of thoughts.Insurance coverage corporations in Cell, AL, like many locations, compete for purchasers.

This competitors usually results in aggressive pricing and various choices, which could be overwhelming. This comparability will provide you with the lowdown on totally different suppliers, their reputations, and their perks, so you may make a sensible selection.

Main Insurance coverage Suppliers in Cell, AL

A number of main insurance coverage corporations serve Cell, AL, every with their very own strengths and weaknesses. Understanding these variations is essential for locating the most effective deal.

- State Farm: A well-established nationwide participant, State Farm is well known for its intensive community and lengthy historical past within the insurance coverage business. They usually have a powerful presence in native communities, and their customer support and declare dealing with procedures are regularly talked about. They sometimes supply a broad vary of merchandise, together with automobile insurance coverage.

- Geico: Identified for its affordability and widespread attain, Geico usually emerges as a prime contender within the value wars. Their aggressive pricing technique generally interprets to aggressive quotes. Their digital platforms and on-line providers are in style with trendy shoppers.

- Progressive: A tech-savvy firm, Progressive usually makes use of progressive methods to draw clients. Their digital instruments and on-line providers are regularly praised, whereas their pricing methods and claims dealing with are price contemplating.

- Allstate: Allstate is a considerable participant within the insurance coverage business. They sometimes supply a various vary of merchandise, together with automobile insurance coverage, and their native presence could be vital. They regularly have a strong status for declare dealing with and customer support.

- Farmers Insurance coverage: A powerful regional participant, Farmers Insurance coverage usually has an area focus. Their brokers’ intensive data of the Cell, AL space and its explicit driving situations could be a vital plus. Their monetary stability and status are sometimes extremely regarded.

Fame and Buyer Critiques

Buyer critiques and status are important elements to think about when selecting an insurance coverage firm. Phrase-of-mouth and on-line suggestions paint an image of how straightforward it’s to cope with a specific supplier.

- State Farm usually will get optimistic suggestions for his or her declare dealing with and native presence. Prospects regularly reward their responsive service.

- Geico, whereas regularly praised for its low charges, generally receives blended critiques concerning the claims course of. On-line suggestions generally factors to a necessity for higher customer support, particularly in additional complicated claims.

- Progressive is usually lauded for its user-friendly digital platforms and buyer assist, however some suggestions suggests inconsistencies in claims dealing with.

- Allstate often receives favorable critiques concerning customer support and declare dealing with. Their native presence and brokers are extremely valued by many shoppers.

- Farmers Insurance coverage is usually praised for its native brokers’ data and responsiveness, resulting in a optimistic buyer expertise. Their declare course of is regularly considered as environment friendly.

Monetary Stability

Insurance coverage corporations’ monetary stability is essential. A financially robust firm is much less prone to face points that might have an effect on your protection.

- All main gamers within the Cell, AL insurance coverage market typically have a powerful monetary standing, as indicated by their monetary rankings from acknowledged ranking companies.

Claims Course of and Buyer Service

The declare course of and customer support are important for a clean expertise whenever you want protection.

- Every firm has its personal course of for dealing with claims. Thorough analysis and comparability of critiques can present a greater understanding of every firm’s method. Search for corporations that emphasize effectivity and buyer satisfaction of their declare procedures.

Reductions Supplied

Totally different corporations supply numerous reductions. Reductions can considerably decrease your insurance coverage premiums.

- Reductions range throughout corporations, and particulars about particular reductions can be found immediately from every supplier.

Comparability Desk

| Insurance coverage Supplier | Fame | Monetary Stability | Claims Course of | Buyer Service | Reductions |

|---|---|---|---|---|---|

| State Farm | Excessive | Wonderful | Good | Good | Varied |

| Geico | Blended | Wonderful | Blended | Reasonable | Varied |

| Progressive | Reasonable | Wonderful | Reasonable | Good | Varied |

| Allstate | Good | Wonderful | Good | Good | Varied |

| Farmers Insurance coverage | Excessive | Wonderful | Good | Wonderful | Varied |

Methods for Discovering Reasonably priced Insurance coverage

Snagging low-cost automobile insurance coverage in Cell, AL, is not rocket science, but it surely does take slightly know-how. Realizing the fitting methods can prevent critical coin in your premiums. From evaluating quotes on-line to leveraging reductions, we have got the lowdown on getting the most effective deal.Discovering the proper automobile insurance coverage plan in your wants entails greater than only a fast search.

Understanding the totally different techniques and instruments out there can considerably affect your last premium price. Let’s dive into the nitty-gritty of discovering reasonably priced insurance coverage.

Acquiring A number of Quotes

Getting a number of quotes is vital to discovering the most effective value. Do not simply accept the primary quote you see – store round! Totally different corporations have totally different pricing buildings, so evaluating apples to apples is essential. This proactive method can result in substantial financial savings.

Utilizing On-line Comparability Instruments

On-line comparability instruments are your finest pal when looking for reasonably priced automobile insurance coverage. These instruments act as a central hub, gathering quotes from a number of corporations concurrently. This streamlined course of saves you the trouble of manually contacting every supplier.

Worth of Impartial Insurance coverage Brokers

Impartial insurance coverage brokers are extra than simply middlemen. They act as your private shopper, representing your pursuits throughout numerous insurance coverage corporations. Their experience in navigating the insurance coverage panorama can usually yield extra aggressive charges than you’d discover by yourself.

Leveraging Reductions and Bundling Choices

Reductions and bundling are your secret weapons within the combat for reasonably priced insurance coverage. Search for reductions based mostly in your driving report, security options in your automobile, and even your location. Bundling your automobile insurance coverage with different providers like residence or life insurance coverage can generally unlock further financial savings.

Step-by-Step Information to Evaluating Quotes On-line

1. Establish Your Wants

What protection do you require? Contemplate elements like legal responsibility, collision, complete, and medical funds. Specify your automobile’s particulars, together with make, mannequin, and yr.

2. Use a Comparability Software

Enter your data right into a dependable on-line comparability device. Select respected corporations with an excellent observe report.

3. Evaluate Quotes

Fastidiously evaluate quotes from totally different corporations, noting the small print of every coverage, together with protection limits and premiums.

4. Assess Reductions

Examine for any reductions you might qualify for, like good scholar or secure driver reductions.

5. Request Additional Data

Contact insurance coverage corporations immediately for clarification or further particulars.

6. Make Your Resolution

Select the coverage that most accurately fits your wants and funds.

On-line Comparability Web sites

| Web site | Description |

|---|---|

| Insurify | A preferred comparability platform that gives quotes from numerous insurers. |

| Policygenius | A complete on-line platform for evaluating insurance coverage insurance policies, together with automobile insurance coverage. |

| Insure.com | A well known comparability device that helps customers discover the most effective offers on automobile insurance coverage. |

| NerdWallet | A monetary useful resource that features a automobile insurance coverage comparability device, offering complete data. |

Understanding Insurance coverage Protection Choices: Low-cost Automotive Insurance coverage In Cell Al

So, you are tryna snag some candy offers on automobile insurance coverage in Cell, AL? Realizing your protection choices is vital to getting the most effective bang in your buck. Various kinds of protection supply various ranges of safety, so understanding the small print is essential for making sensible decisions.Insurance coverage protection is sort of a security web, defending you from monetary destroy if one thing goes sideways together with your experience.

Totally different coverages handle numerous situations, from fender benders to whole wrecks. Understanding these choices empowers you to choose the fitting coverage in your wants and funds.

Legal responsibility Protection Defined

Legal responsibility protection kicks in whenever you’re at fault for an accident. It covers damages you trigger to different individuals’s property or accidents you inflict on them. Having enough legal responsibility protection is tremendous necessary as a result of it is legally required in most states, and it protects you from hefty lawsuits and monetary burdens. For instance, in case you trigger a crash and harm somebody’s automobile or injure them, your legal responsibility protection will assist pay for his or her repairs and medical payments.

With out it, you could possibly face a mountain of debt.

Collision Protection: Defending Your Experience

Collision protection comes into play when your automobile will get broken in an accident, no matter who’s at fault. It is a essential layer of safety, particularly in Cell, the place parking could be a wild west. Think about you are parked, and a careless driver bumps into your automobile. Collision protection steps in to cowl the repairs, irrespective of who’s responsible.

Complete Protection: Past the Collision

Complete protection is like an additional layer of safety, protecting harm to your automobile from issues past accidents. Suppose issues like vandalism, hearth, hail, and even falling objects. Having complete protection means you are lined even in case you’re circuitously concerned in a collision. Think about parking your automobile outdoors and coming again to seek out it broken by hail.

Complete protection will enable you get it mounted.

Uninsured/Underinsured Motorist Protection: A Security Web

Uninsured/underinsured motorist protection is a crucial safeguard when coping with drivers who lack or have inadequate insurance coverage. For those who’re in an accident with somebody who’s uninsured or underinsured, this protection steps in to pay in your damages. In Cell, like many areas, it is a must-have since accidents with uninsured drivers occur extra usually than you’d assume. It is basically an additional defend in your monetary well-being.

Comparability of Protection Choices

| Protection Kind | Description | Advantages |

|---|---|---|

| Legal responsibility | Covers damages you trigger to others. | Protects you from lawsuits and monetary burdens. |

| Collision | Covers harm to your automobile in an accident, no matter fault. | Repairs your automobile after an accident. |

| Complete | Covers harm to your automobile from occasions aside from accidents (e.g., vandalism, hearth). | Protects in opposition to harm from sudden occasions. |

| Uninsured/Underinsured Motorist | Covers you if concerned in an accident with an uninsured or underinsured driver. | Protects your monetary well-being in accidents with at-fault drivers who’ve inadequate insurance coverage. |

Particular Reductions and Bundling Alternatives

Snag some critical financial savings in your Cell, AL automobile insurance coverage! Reductions are like hidden gems—you gotta know the place to look. Bundling is a serious game-changer too, and we’ll break down how one can get the most effective deal potential.Discovering the fitting automobile insurance coverage in Cell, AL could be a whole mission, but it surely would not need to be a headache.

Realizing about out there reductions can severely reduce down your premium, and bundling can prevent much more. Let’s dive into the juicy particulars.

Widespread Reductions in Cell, AL

Realizing about out there reductions is vital to scoring a candy deal. Insurance coverage corporations like to reward accountable drivers and people who take proactive steps to decrease their danger. These reductions can add up and make a big distinction in your month-to-month funds.

- Protected Driving Habits: Firms usually reward drivers with clear driving information. This might embrace issues like having no accidents or site visitors violations in the previous few years. It is like a gold star for accountable driving.

- Good Pupil Standing: For those who’re a scholar with an excellent educational report, you may qualify for a reduction. Insurance coverage corporations usually see college students as lower-risk drivers, which interprets into decrease premiums.

- Particular Car Varieties: Sure automobiles are statistically safer and have a decrease danger of accidents, like electrical vehicles. Insurance coverage corporations may supply reductions for these.

- Bundling Insurance coverage: It is a large alternative to avoid wasting. Combining your automobile insurance coverage with different insurance policies, like residence or renters insurance coverage, can usually result in a considerable low cost. Consider it as a multi-service bundle deal.

Examples of Reductions for Particular Profiles

Listed here are some examples of how these reductions work in apply:

- Protected Driving Instance: A driver with a clear report and no accidents for 5 years may get a 15% low cost on their automobile insurance coverage. It is a main win, saving them a whole lot of {dollars} yearly.

- Good Pupil Instance: A school scholar with a 3.5 GPA may get a ten% low cost on their automobile insurance coverage. It is a bonus for sustaining an excellent educational report, which regularly interprets to accountable conduct.

- Car Kind Instance: An electrical automobile (EV) proprietor may obtain a 5% low cost. Insurance coverage corporations acknowledge EVs as lower-risk automobiles, usually with fewer accident-prone options in comparison with conventional automobiles.

Bundling Insurance coverage Providers

Combining a number of insurance policies can considerably decrease your insurance coverage prices. It is a win-win for each you and the insurance coverage supplier. It is like a loyalty program the place you save extra for being a buyer throughout a number of providers.

- Combining Residence and Automotive Insurance coverage: When you have a house and automobile, insuring each with the identical supplier usually comes with a reduction. This bundling technique can prevent a noticeable quantity on each your property and automobile insurance coverage premiums. Consider it as a bundle deal.

- Combining Renters and Automotive Insurance coverage: Much like combining residence and automobile, insuring each your renters and automobile insurance coverage with the identical firm may result in a reduction. It is like having a loyalty program with the insurance coverage firm.

Sustaining a Good Driving Document

A spotless driving report is essentially the most vital issue influencing your insurance coverage charges. A superb report displays accountable conduct on the street, which interprets to decrease danger for the insurance coverage firm. It is the easiest way to safe decrease premiums.

A superb driving report is a robust device for saving cash on automobile insurance coverage.

Varied Methods Suppliers Provide Reductions

Insurance coverage suppliers supply reductions in numerous methods. Some are tied to particular packages, whereas others are based mostly in your profile and driving historical past. The secret is to discover all of the choices and see which of them apply to you.

Illustrative Examples of Insurance coverage Quotes

Discovering the fitting automobile insurance coverage in Cell, AL can really feel like navigating a maze. However do not sweat it! We’re breaking down how insurance coverage quotes work, so you’ll be able to rating the most effective deal. Realizing what elements have an effect on your premium is vital to getting the bottom potential charge.Insurance coverage corporations use a posh system to calculate your premium. Various factors play an enormous position, and understanding them will help you store smarter.

Consider it like this: your driving report, your automobile’s options, and even the place you reside all contribute to the ultimate price ticket.

Hypothetical Automotive Insurance coverage Quotes

Totally different situations will lead to totally different insurance coverage quotes. Elements like your age, driving report, and the automobile you drive all affect the premium. Let’s take a look at some examples for instance how these elements have an effect on your last value.

| Situation | Driver Profile | Car | Premium (Approx.) | Rationalization |

|---|---|---|---|---|

| Situation 1: Younger Driver, Fundamental Protection | 22-year-old with a clear driving report | Used sedan | $1,800 | Younger drivers usually have increased premiums on account of a perceived increased danger. A fundamental coverage with restricted protection is mirrored on this quote. |

| Situation 2: Skilled Driver, Enhanced Protection | 35-year-old with a clear driving report, 5+ years of driving expertise | Luxurious SUV | $1,200 | Older drivers with good information are inclined to get higher charges. A costlier automobile may include a better premium. |

| Situation 3: Driver with Accidents | 28-year-old with a minor accident on report | Compact Automotive | $1,500 | Accidents in your driving historical past will often improve your premium. |

| Situation 4: Driver with Bundled Providers | 30-year-old with a clear driving report, bundling with residence insurance coverage | Mid-size SUV | $1,000 | Bundling your insurance coverage (residence and auto) can usually get you a reduction. |

Influence of Reductions

Reductions can considerably decrease your premium. Understanding what reductions can be found in your space can prevent a bundle. Many corporations supply reductions for issues like good scholar standing, secure driving habits, or anti-theft gadgets.

- Protected Driver Reductions: Firms usually reward drivers with a clear report, which may translate into decrease premiums.

- Multi-Coverage Reductions (Bundling): Insurance coverage corporations usually supply a reduction in case you bundle your property and auto insurance coverage with them.

- Anti-theft Gadget Reductions: Putting in anti-theft gadgets can lower your danger, which in flip lowers your premiums.

- Defensive Driving Programs: Finishing defensive driving programs can enhance your driving report, which can lead to decrease premiums.

Decoding Insurance coverage Quotes

Insurance coverage quotes usually embrace numerous protection sorts and limits. It is necessary to grasp the totally different choices and their affect in your premium. Take note of the specifics of every coverage.

- Legal responsibility Protection: This covers the damages you trigger to others in an accident.

- Collision Protection: This covers harm to your automobile in an accident, no matter who’s at fault.

- Complete Protection: This covers harm to your automobile from occasions like hail, vandalism, or theft.

Bundling Instance

Think about you’ve gotten a house and auto coverage with the identical firm. Bundling your property and automobile insurance coverage may lead to a big low cost, decreasing your general premium. The precise quantity of the low cost varies relying on the corporate and the precise insurance policies.

Contacting Insurance coverage Suppliers and Brokers

Discovering the fitting automobile insurance coverage in Cell, AL, is less complicated than you assume! Realizing the way to contact suppliers and brokers immediately can prevent critical time and probably, critical money. It is all about getting the most effective deal potential, and that begins with making the fitting connections.

Strategies for Contacting Insurance coverage Suppliers

Insurance coverage corporations in Cell supply numerous methods to attach with them. You’ll be able to usually discover their contact data on their web sites. Do not be shy to provide them a name, and even drop by their native workplace in case you desire a face-to-face chat. E mail can be a fantastic choice for fast questions and follow-ups. This selection offers you flexibility in the way you talk and discover the most effective resolution.

Significance of Choosing a Respected Agent

Working with a good insurance coverage agent is essential. A superb agent acts as your advocate, understanding your wants and guiding you thru the complicated world of insurance coverage. They’ll prevent time and trouble by evaluating totally different insurance policies and discovering the most effective match in your state of affairs. In addition they have up-to-date data of the newest protection choices and reductions.

Requesting Quotes from Totally different Suppliers

Getting quotes from numerous suppliers is vital to discovering essentially the most reasonably priced automobile insurance coverage. It is a simple course of. Simply go to the corporate’s web site, use their on-line quote device, or give them a name. Be ready to supply details about your automobile, driving historical past, and desired protection. Do not hesitate to ask questions on particular insurance policies.

Contact Data for Main Suppliers

Discovering the fitting contact data is tremendous necessary. It streamlines the entire course of. Sadly, I am unable to present actual contact data for each single supplier in Cell, AL. This data modifications regularly. Nonetheless, you will discover this information on the official web sites of the businesses.

Function of Impartial Brokers in Discovering the Finest Deal

Impartial brokers aren’t tied to 1 insurance coverage firm. This implies they will evaluate insurance policies from numerous suppliers and discover the most effective deal for you. They act as unbiased brokers, working in your finest curiosity. They will store round and enable you discover essentially the most reasonably priced choice that meets your particular wants.

Contact Data for Suppliers and Brokers (Illustrative Instance)

| Insurance coverage Supplier | Web site | Telephone Quantity (Instance) |

|---|---|---|

| State Farm | statefarm.com | (123) 456-7890 |

| Progressive | progressive.com | (987) 654-3210 |

| Geico | geico.com | (555) 111-2222 |

| Allstate | allstate.com | (123) 456-7890 |

Word: This desk is an instance and the cellphone numbers aren’t actual. All the time confirm contact data on the official firm web sites.

Ultimate Ideas

In conclusion, securing reasonably priced automobile insurance coverage in Cell, AL entails cautious analysis, comparability buying, and understanding your wants. By using on-line instruments, unbiased brokers, and understanding protection choices, you will discover the most effective coverage in your funds and driving habits. This information offers a powerful basis for making knowledgeable choices and saving cash in your automobile insurance coverage premiums.

Query Financial institution

What are frequent reductions out there for automobile insurance coverage in Cell, AL?

Reductions range by supplier however can embrace secure driving incentives, good scholar standing, and bundling with different insurance coverage merchandise like residence or renters insurance coverage.

How does my driving report have an effect on my insurance coverage premiums in Cell, AL?

A clear driving report typically ends in decrease premiums, whereas accidents or site visitors violations can considerably improve your charges.

What are the various kinds of automobile insurance coverage protection out there in Cell, AL?

Widespread coverages embrace legal responsibility, collision, complete, uninsured/underinsured motorist protection. Understanding every sort helps you choose the suitable protection in your wants.

How can I get a number of insurance coverage quotes in Cell, AL?

Use on-line comparability instruments, work with unbiased insurance coverage brokers, or contact a number of suppliers on to receive numerous quotes.