Can I take advantage of a PO field for automotive insurance coverage? This query pops up for lots of people, particularly these with distinctive dwelling conditions. A PO field, not like a avenue handle, is a mail receiving level, and you’ll want to know if insurance coverage corporations will settle for it. This exploration dives into the small print, analyzing the insurance policies of varied insurance coverage suppliers, the impression on processes, and the sensible implications.

We’ll cowl conditions the place a PO field may be useful, and when it might result in hassle.

Many elements affect whether or not or not a PO field is a viable choice in your automotive insurance coverage. Some insurance coverage corporations readily settle for PO containers, whereas others would possibly require extra documentation or have particular restrictions. Understanding these nuances is vital to creating an knowledgeable determination.

Understanding PO Field Utilization for Automobile Insurance coverage

A PO Field, or postal field, provides a personal mailing handle distinct from a bodily avenue handle. This distinctive handle is commonly favored by people looking for privateness or those that stay in shared areas or short-term areas. Understanding how a PO Field features within the context of automotive insurance coverage is essential for guaranteeing a clean and correct software course of.Utilizing a PO Field for automotive insurance coverage is a viable choice, although there may be slight variations within the course of.

Insurance coverage suppliers have to confirm your handle to evaluate threat and adjust to regulatory necessities. The secret is to make sure all obligatory data is precisely supplied and clearly linked to the PO Field.

PO Field Definition and Performance

A PO Field is a delegated mail receptacle situated at a submit workplace. It gives a personal mailing handle for people or companies, separate from their bodily residence or enterprise location. This handle is commonly chosen for privateness, safety, or comfort. It permits recipients to obtain mail with out disclosing their precise residential or enterprise handle.

PO Field vs. Avenue Tackle

A PO Field differs considerably from a avenue handle. A avenue handle identifies a selected location on a avenue, pinpointing a property or residence. A PO Field, in distinction, is a delegated mail receptacle at a submit workplace, not a bodily construction. This distinction would possibly affect how your insurance coverage supplier verifies your handle and handles your software.

Implications of Utilizing a PO Field for Automobile Insurance coverage

Utilizing a PO Field for automotive insurance coverage would possibly entail some additional steps within the verification course of. Insurance coverage corporations could require extra documentation or verification strategies to substantiate the validity of the PO Field handle. The verification course of ensures compliance with laws and a good threat evaluation. It’s important to be clear and supply all obligatory data requested by the insurance coverage supplier.

Causes for Selecting a PO Field

People could go for a PO Field for varied causes, together with privateness issues, safety, or short-term residence. It may also be advantageous for individuals who share a residence or earn a living from home and like a separate enterprise or private mailing handle. In some instances, a PO Field could be a sensible answer for people with frequent handle modifications.

Sorts of PO Field Companies

Publish workplace companies supply varied PO Field choices, various in dimension, value, and options. These companies could embody choices for various storage capability, whether or not or not they’ve mail forwarding, and the accessibility of the containers. It is essential to decide on a service that fits your wants and price range. A easy comparability chart of varied choices can assist in deciding on probably the most appropriate PO Field service.

| PO Field Service | Description | Value |

|---|---|---|

| Normal PO Field | Primary mail receptacle at a submit workplace. | Variable |

| Enhanced PO Field | Contains options like mail forwarding and on-line entry. | Greater than commonplace |

| Enterprise PO Field | Bigger capability and specialised companies for companies. | Variable, typically increased |

Insurance coverage Firm Insurance policies Relating to PO Bins

Navigating the world of automotive insurance coverage may be difficult, particularly when coping with uncommon addresses like PO Bins. Understanding the insurance policies of various insurance coverage suppliers is essential for a clean and hassle-free course of. This part dives into the specifics of insurance coverage firm insurance policies relating to PO Field utilization, masking widespread practices, documentation necessities, and worldwide variations.Insurance coverage corporations typically have particular pointers for accepting PO Bins as legitimate addresses for automotive insurance coverage.

These insurance policies range considerably relying on the corporate, the nation, and the precise state of affairs. This necessitates an intensive understanding to make sure your protection stays intact.

Widespread Insurance policies of Main Insurance coverage Firms

Insurance coverage corporations usually settle for PO Bins, however typically with particular necessities. This typically consists of verifying the legitimacy of the PO Field and confirming its affiliation with the policyholder. These necessities normally intention to make sure the safety of the coverage and forestall fraudulent claims.

Acceptance of PO Bins as Legitimate Addresses

Many insurance coverage corporations now settle for PO Bins as legitimate addresses, supplied sure situations are met. This acceptance fee has elevated lately, reflecting the rising prevalence of PO Field utilization. Nevertheless, the acceptance may be depending on the precise location and the corporate’s inner insurance policies.

Comparability of Insurance coverage Insurance policies Throughout Nations

The acceptance of PO Bins for automotive insurance coverage varies throughout nations. In some areas, PO Bins are broadly accepted, whereas others could have extra stringent necessities or outright prohibitions. That is influenced by native laws and the precise dangers related to PO Field utilization in these areas.

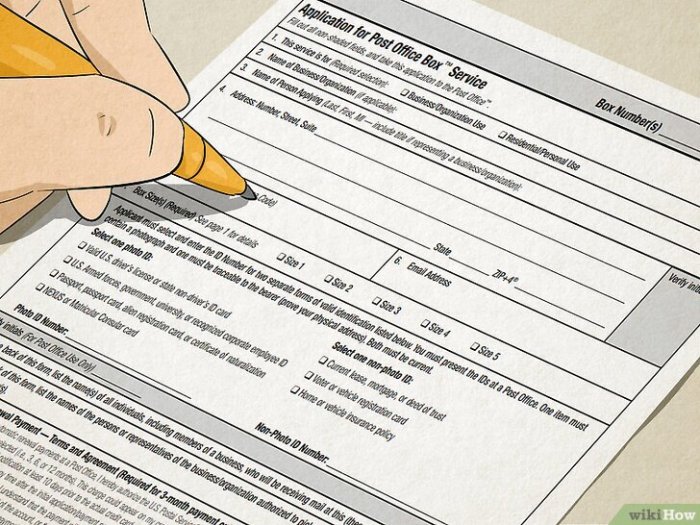

Documentation Necessities for Utilizing a PO Field

Particular documentation could also be required to make use of a PO Field for automotive insurance coverage. These would possibly embody a replica of the PO Field rental settlement, proof of residency, or extra verification paperwork. The particular paperwork range from firm to firm. Insurance coverage corporations want to make sure the policyholder’s identification and the legitimacy of the PO Field handle.

Desk Evaluating Insurance coverage Supplier Acceptance of PO Bins

| Insurance coverage Supplier | Accepts PO Bins? | Further Necessities |

|---|---|---|

| Instance Supplier 1 | Sure | Copy of PO Field rental settlement, legitimate government-issued ID, proof of residency (utility invoice inside 30 days). |

| Instance Supplier 2 | No | Requires a bodily avenue handle. |

| Instance Supplier 3 | Sure | Copy of PO Field rental settlement, affirmation from the postal service relating to the PO Field’s validity. |

Word: This desk gives hypothetical examples. Precise insurance policies and necessities could differ. At all times verify instantly with the insurance coverage supplier for probably the most up-to-date and exact data.

Influence on Automobile Insurance coverage Processes

Utilizing a PO Field in your automotive insurance coverage could be a handy choice, but it surely does include sure implications for the applying and claims processes. Understanding these nuances is essential to make sure a clean expertise and keep away from potential issues. Insurance coverage corporations have particular procedures for dealing with PO Field addresses, and failing to conform can result in delays and even rejection of your software.

Insurance coverage Software Course of Impacts

Using a PO Field can introduce complexities into the insurance coverage software course of. Insurance coverage corporations require verifiable data to evaluate threat and decide premiums. Offering a PO Field handle could necessitate extra documentation or verification steps from the insurer. This may contain requesting additional particulars or contacting the postal service to substantiate the handle’s validity. These extra steps could enhance the processing time in your software.

Doc Supply Implications

Insurance coverage paperwork, comparable to coverage agreements, renewal notices, and declare varieties, usually have to be delivered to the insured’s handle of report. Utilizing a PO Field can have an effect on the supply of those paperwork, doubtlessly resulting in delays or misdeliveries. Insurers typically depend on the postal service for these deliveries, and if the handle is just not simply verifiable or accessible, the method may be impacted.

Claims Course of Implications

When a declare arises, insurers have to contact the policyholder to evaluate the state of affairs and course of the declare. If a PO Field is used, the insurance coverage firm wants to make sure they’ve the right contact data to speak with the policyholder. Utilizing a PO Field for automotive insurance coverage claims can generally lead to slower declare processing instances, as insurers have to confirm the declare and make sure the appropriate individual is contacted.

Delays in responding to communications or verifying your identification might doubtlessly have an effect on the declare end result.

PO Field Tackle Verification

Insurance coverage corporations make use of varied strategies to confirm PO Field addresses. These strategies could embody contacting the postal service instantly to substantiate the handle’s validity, or cross-referencing it with different out there data. The particular verification strategies used could range relying on the insurer. The extent of verification required typically is determined by the complexity of the declare or software.

Potential Drawback Eventualities, Can i exploit a po field for automotive insurance coverage

There are conditions the place utilizing a PO Field for automotive insurance coverage would possibly pose issues. As an example, if the insurance coverage firm has problem verifying the PO Field handle, your software could also be delayed or rejected. Moreover, when you expertise a declare, the insurance coverage firm could encounter problem speaking with you successfully, doubtlessly inflicting delays within the declare decision course of.

A major delay in responding to communications relating to the declare might lead to issues. Moreover, some insurance coverage corporations could not settle for PO Bins as a main handle for policyholders.

Sensible Concerns and Options

Utilizing a PO Field for automotive insurance coverage could be a handy choice for some, but it surely’s essential to know the potential advantages and disadvantages. Navigating the complexities of insurance coverage insurance policies and processes when utilizing a PO Field requires cautious consideration. This part explores the benefits and drawbacks, outlining conditions the place it is helpful, problematic, and suggesting alternate options.Understanding the nuances of insurance coverage corporations’ insurance policies relating to PO Bins is important.

Some corporations would possibly settle for PO Bins with out difficulty, whereas others would possibly impose restrictions or require extra documentation. This may range enormously relying on the insurance coverage supplier and the precise circumstances.

Conditions The place Utilizing a PO Field May Be Useful

Utilizing a PO Field for automotive insurance coverage can supply comfort, particularly for people with frequent handle modifications. That is significantly helpful for individuals who relocate typically, comparable to college students, navy personnel, or folks in short-term housing. A PO Field gives a steady mailing handle that can be utilized for automotive insurance coverage, even when the bodily handle is altering.

Conditions The place Utilizing a PO Field May Be Problematic

Utilizing a PO Field for automotive insurance coverage may be problematic in conditions requiring in-person inspections or paperwork supply. Some insurance coverage corporations would possibly require the bodily presence of the insured or documentation supply on the registered handle, which a PO Field can not fulfill. Moreover, sure companies, comparable to towing or roadside help, may need problem finding the insured at a PO Field handle.

Options to Utilizing a PO Field for Automobile Insurance coverage

Quite a lot of alternate options exist for people who want to keep away from utilizing a PO Field for automotive insurance coverage. These choices embody:

- Utilizing a good friend or member of the family’s handle.

- Using a brief handle service.

- Contacting the insurance coverage firm instantly to know their coverage relating to PO Bins.

- Protecting a bodily handle steady, even when it isn’t ultimate.

Benefits and Disadvantages of Utilizing a PO Field for Automobile Insurance coverage

Utilizing a PO Field for automotive insurance coverage presents each benefits and drawbacks when in comparison with a bodily handle.

| Issue | Benefits | Disadvantages |

|---|---|---|

| Comfort | Simple to alter addresses, significantly helpful for frequent movers | Might trigger difficulties with in-person inspections or doc supply. |

| Privateness | Presents a level of privateness from undesirable mail | Might result in points with towing or roadside help companies. |

| Value | Doubtlessly decrease price for mailing companies | Might incur extra prices for PO Field rental. |

Potential Dangers Related to Utilizing a PO Field for Automobile Insurance coverage

Using a PO Field for automotive insurance coverage presents sure dangers, together with the potential for delays in correspondence or doc supply, which might have an effect on claims processing. The power of service suppliers, comparable to towing corporations or roadside help, to find the insured at a PO Field handle is also impacted.

Illustrative Examples of PO Field Utilization

Utilizing a PO Field for automotive insurance coverage can current each benefits and potential issues. Understanding these nuances is essential for making an knowledgeable determination. This part gives sensible examples for instance the potential outcomes of utilizing a PO Field in your automotive insurance coverage.

State of affairs The place Utilizing a PO Field is Advantageous

A current school graduate, Sarah, bought her first automotive. She lives in a small condominium and would not have a everlasting mailing handle. Utilizing a PO Field for her automotive insurance coverage permits her to keep up knowledgeable and arranged report of her insurance coverage paperwork whereas avoiding potential points associated to her short-term dwelling state of affairs. This streamlined method is especially helpful for these dwelling in short-term or transient conditions.

State of affairs The place Utilizing a PO Field May Result in Issues

Think about a state of affairs the place a home-owner, David, makes use of a PO Field for his automotive insurance coverage. Whereas a PO Field is a legitimate handle, David’s insurance coverage firm would possibly require extra documentation or verification to substantiate the hyperlink between the car and the PO Field handle. This might result in delays in processing the insurance coverage declare or coverage renewal. Additional, the bodily location of the PO Field may be a difficulty if there are points with the car’s location.

How Utilizing a PO Field Impacts Insurance coverage Premiums

Usually, utilizing a PO Field doesn’t instantly impression insurance coverage premiums. The premium calculation is normally based mostly on elements just like the car’s make, mannequin, and utilization. Nevertheless, issues arising from utilizing a PO Field, comparable to delays in processing or extra verification requests, might not directly have an effect on the general insurance coverage course of. You will need to word that totally different insurance coverage corporations have various insurance policies.

Case Research of Profitable PO Field Utilization

A contract graphic designer, Emily, used a PO Field for her automotive insurance coverage. She often travels for work and would not have a hard and fast residence. Emily discovered that utilizing a PO Field was a handy method to handle her insurance coverage paperwork and keep a constant handle for her insurance coverage supplier. The insurance coverage firm required a replica of her lease settlement, which she readily supplied from her PO Field.

Abstract Desk of Eventualities and Outcomes

| State of affairs | Consequence | Influence on Insurance coverage |

|---|---|---|

| Utilizing a PO Field for a brand new school graduate dwelling in a brief condominium. | Streamlined insurance coverage course of, simple doc administration. | No noticeable impression on premiums, environment friendly record-keeping. |

| Utilizing a PO Field for a home-owner who additionally has a everlasting residence handle. | Potential for issues, extra verification requests. | Potential delays in declare processing or coverage renewal. |

| Utilizing a PO Field for a frequent traveler or somebody with short-term dwelling preparations. | Handy technique for sustaining a constant handle. | No direct impression on premiums, however doubtlessly elevated paperwork for verification. |

Consequence Abstract

In conclusion, utilizing a PO field for automotive insurance coverage is not universally problematic, but it surely does include particular issues. Whereas some insurers readily settle for them, others could have stringent necessities. Understanding your insurer’s insurance policies, potential course of impacts, and different choices is essential earlier than making a alternative. Think about the professionals and cons, and weigh them towards your particular wants.

In the event you’re unsure, it is at all times finest to contact your insurance coverage supplier instantly.

FAQ Information: Can I Use A Po Field For Automobile Insurance coverage

Can I take advantage of a PO Field if I am shifting?

Usually, sure, however you may want to tell your insurance coverage firm of the change and guarantee they settle for PO Bins.

What if my insurance coverage firm would not settle for PO Bins?

You would possibly want to make use of a bodily handle or discover different options like a brief handle service.

How do insurance coverage corporations confirm PO Field addresses?

They typically depend on documentation supplied by the PO Field service, so you’ll want to guarantee accuracy and completeness.

Will utilizing a PO field have an effect on my insurance coverage premiums?

Doubtlessly, although it largely is determined by the precise insurance coverage supplier and the elements affecting your threat profile. Some insurers could view PO containers as presenting a better threat of fraud or claims points. Inquire instantly together with your insurer to study extra about how they may calculate your premium.