Is Hotwire automotive rental insurance coverage price it? This important query calls for an intensive investigation, balancing cost-effectiveness in opposition to potential dangers. We’ll dissect Hotwire’s protection, evaluating it to straightforward rental insurance coverage and private journey choices. Understanding the wonderful print and potential limitations is paramount in making an knowledgeable choice.

Hotwire’s insurance coverage typically comes bundled with rental packages, probably saving you upfront prices. Nevertheless, it is vital to grasp the constraints and exclusions. We’ll delve into buyer experiences, analyzing optimistic and unfavourable suggestions, alongside an in depth price comparability. This complete overview equips you with the data to find out if Hotwire’s insurance coverage aligns along with your particular wants and circumstances.

Understanding Hotwire Automobile Rental Insurance coverage

Hotwire, identified for its discounted automotive leases, typically bundles insurance coverage choices. Understanding the specifics of this insurance coverage is essential for vacationers to make sure they’re adequately protected throughout their journey. The protection supplied can differ considerably from customary rental insurance coverage insurance policies, requiring cautious consideration earlier than making a reserving.

Typical Protection Provided by Hotwire Insurance coverage

Hotwire automotive rental insurance coverage sometimes contains legal responsibility protection, which protects you from monetary accountability in the event you trigger injury to a different particular person’s automobile or harm to a different occasion. Nevertheless, the extent of this protection can differ relying on the particular phrases and circumstances. This fundamental protection is often included within the rental package deal at a lowered price, however typically comes with limitations.

Breakdown of Protection Choices

Hotwire ceaselessly affords extra protection choices past legal responsibility, corresponding to collision and complete insurance coverage. Collision protection protects you in opposition to injury to the rental automobile in an accident, no matter who’s at fault. Complete protection supplies safety in opposition to damages from perils aside from collisions, together with theft, vandalism, and weather-related incidents. These extra protections, nonetheless, typically include deductibles and limits.

Limitations and Exclusions

It is essential to notice that Hotwire insurance coverage insurance policies ceaselessly have limitations and exclusions. For instance, protection could not lengthen to pre-existing injury to the automobile, sure sorts of injury brought on by negligence, or particular geographic areas. Additionally, protection could not cowl damages ensuing from reckless driving or intoxicated operation of the automobile. All the time overview the wonderful print to totally perceive the phrases and circumstances.

Examples of Inadequate Protection

A scenario the place Hotwire insurance coverage may be inadequate is if you find yourself concerned in an accident the place the opposite driver is at fault and the damages exceed your protection limits. Equally, in case you are driving in a distant space with restricted entry to emergency providers and expertise a major mechanical failure, your Hotwire insurance coverage won’t cowl the prices of towing or repairs.

It’s essential to evaluate your private danger tolerance and journey plans when evaluating Hotwire insurance coverage.

Comparability of Hotwire Insurance coverage to Commonplace Rental Insurance coverage

| Function | Hotwire Insurance coverage | Commonplace Rental Insurance coverage |

|---|---|---|

| Legal responsibility Protection | Often included, however with potential limitations. | Usually included as a normal a part of the coverage. |

| Collision Protection | Might or will not be included; typically with excessive deductibles. | Often accessible as an add-on; varies when it comes to protection. |

| Complete Protection | Might or will not be included; typically with excessive deductibles. | Often accessible as an add-on; varies when it comes to protection. |

| Deductibles | Often larger than customary insurance policies. | Can differ however usually decrease than Hotwire’s. |

| Exclusions | Potential exclusions associated to pre-existing injury or particular geographic areas. | Usually fewer exclusions, with clear phrases and circumstances. |

Evaluating the 2 insurance coverage sorts reveals that customary rental insurance coverage sometimes affords extra complete protection with decrease deductibles and fewer exclusions. The desk illustrates that Hotwire insurance coverage, whereas probably cost-effective, typically has limitations.

Evaluating the Value-Effectiveness of Hotwire Insurance coverage

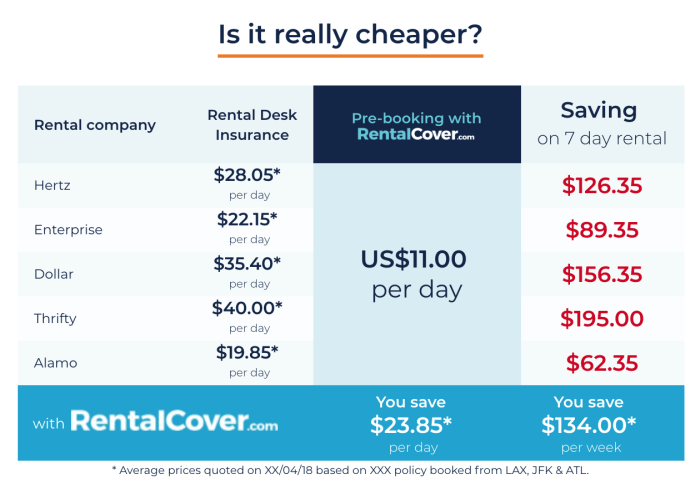

Hotwire’s bundled automotive rental insurance coverage presents a compelling proposition, however its true worth hinges on a cautious comparability with standalone choices. Understanding the elements influencing its worth and when it may be a prudent alternative is essential for savvy vacationers. This evaluation delves into the cost-effectiveness of Hotwire insurance coverage, contemplating numerous variables that will help you make knowledgeable choices.A important facet of evaluating Hotwire’s insurance coverage is knowing how its pricing construction compares to buying separate protection.

Usually, the bundled insurance coverage supplied by Hotwire is designed to be aggressive with, and even barely cheaper than, buying complete insurance coverage straight from an insurance coverage supplier. Nevertheless, this distinction can differ primarily based on quite a few elements, so an in depth evaluation is significant.

Comparability of Hotwire Insurance coverage Prices to Separate Protection

Evaluating Hotwire’s insurance coverage to standalone choices requires cautious consideration of coverage specifics. Hotwire’s package deal typically contains legal responsibility protection, collision injury waiver, and typically private accident insurance coverage. Separate insurance policies may provide extra customization, probably protecting extra perils or offering larger protection limits. Nevertheless, the general price could outweigh the perceived advantages. The secret’s to meticulously study the particular phrases and circumstances of every choice to assess the true worth proposition.

Impression of Rental Particulars on Insurance coverage Prices

The price of Hotwire insurance coverage is not static; it is extremely influenced by the particular rental particulars. The automobile kind considerably impacts the insurance coverage premium. Luxurious automobiles typically entice larger premiums because of their elevated alternative worth. Rental period additionally performs a job; longer leases usually end in larger insurance coverage prices, reflecting the elevated publicity to potential damages. Moreover, the pick-up and drop-off places can typically affect the worth, as sure areas might need larger dangers related to accidents.

Conditions Justifying Hotwire Insurance coverage

Hotwire’s bundled insurance coverage may be a worthwhile choice in sure situations. For vacationers who prioritize simplicity and comfort, the bundled package deal can streamline the rental course of, eliminating the necessity to seek for and buy separate insurance coverage. Furthermore, it could possibly present a great worth proposition if the coverage adequately covers the potential dangers of the rental. If the traveler is assured of their potential to handle any minor damages and the protection supplied by Hotwire meets their wants, it might show cost-effective.

The Position of Deductibles in Insurance coverage Prices

Deductibles considerably affect the worth of insurance coverage, each Hotwire’s bundled and separate insurance policies. Decrease deductibles sometimes end in larger premiums, because the insurance coverage firm assumes a better monetary accountability for potential damages. Conversely, larger deductibles scale back premiums however shift a better monetary burden onto the renter in case of an accident. The traveler should rigorously weigh the trade-offs between price and potential out-of-pocket bills.

Insurance coverage Choices and Prices

| Insurance coverage Choice | Description | Estimated Value (USD) |

|---|---|---|

| Hotwire Fundamental Insurance coverage | Legal responsibility protection, fundamental collision injury waiver | $25-$50 |

| Hotwire Enhanced Insurance coverage | Legal responsibility protection, collision injury waiver, extra extras | $50-$100 |

| Standalone Complete Insurance coverage | Complete protection, larger limits | $30-$80 |

Be aware: Prices are estimated and might differ considerably primarily based on the particular rental particulars and insurance coverage supplier.

Analyzing Buyer Experiences with Hotwire Insurance coverage

Buyer opinions paint a nuanced image of Hotwire’s automotive rental insurance coverage choices. Whereas some reward its affordability, others specific concern over protection limitations and the claims course of. Understanding these various views is essential to evaluating the true worth proposition of Hotwire insurance coverage within the context of different rental suppliers.Hotwire’s strategy to automotive rental insurance coverage, typically centered on offering fundamental protection at aggressive costs, has attracted prospects searching for budget-friendly choices.

Nevertheless, an intensive examination of buyer suggestions reveals each optimistic and unfavourable elements that form the general expertise. This evaluation delves into the specifics of those experiences, evaluating them to different insurance coverage suppliers and highlighting recurring themes to supply a complete understanding.

Widespread Buyer Opinions and Suggestions

Buyer opinions on numerous platforms provide insights into the strengths and weaknesses of Hotwire’s insurance coverage. Optimistic suggestions ceaselessly highlights the aggressive pricing of the insurance coverage, permitting budget-conscious vacationers to safe protection with out overspending. Conversely, unfavourable opinions ceaselessly point out the perceived limitations of the protection, particularly in areas corresponding to collision injury or complete protection.

Abstract of Optimistic and Unfavourable Experiences

- Optimistic experiences typically heart across the cost-effectiveness of Hotwire’s insurance coverage. Prospects ceaselessly point out how the low worth made it a gorgeous choice in comparison with different rental suppliers. Examples embrace feedback like “I saved a considerable quantity on insurance coverage in comparison with the opposite corporations,” or “The worth was unbeatable; I would not have rented with out the insurance coverage.”

- Unfavourable experiences generally relate to restricted protection. Prospects specific issues about inadequate safety in case of accidents or injury. Examples of this embrace “The protection did not appear complete sufficient for the street journey,” or “I used to be frightened concerning the exclusions for sure sorts of injury.”

Comparability with Different Rental Insurance coverage Suppliers

Evaluating Hotwire’s insurance coverage to different rental suppliers reveals each similarities and variations. Whereas Hotwire typically affords aggressive pricing, the scope of protection can differ considerably. Prospects ceaselessly report that different suppliers provide extra complete choices, although at the next price. This highlights the trade-off between worth and protection that prospects should take into account.

Recurring Themes in Buyer Suggestions

A recurring theme in buyer suggestions is the necessity for readability relating to protection specifics. Many purchasers specific confusion over the wonderful print and exclusions, resulting in anxiousness about potential gaps in safety. One other recurring concern revolves across the claims course of. Opinions typically point out the complexities or delays related to submitting a declare, probably impacting the general buyer expertise negatively.

Desk Summarizing Buyer Opinions

| Class | Buyer Suggestions Examples |

|---|---|

| Optimistic | “Reasonably priced worth, nice worth for cash”; “Straightforward so as to add to my reserving”; “Saved so much in comparison with different choices” |

| Unfavourable | “Restricted protection, not complete sufficient”; “Confused about exclusions”; “Advanced claims course of”; “Nervous about gaps in safety” |

| Impartial | “Respectable protection for the worth”; “Insurance coverage was wonderful, no points”; “Enough protection for a fundamental journey” |

Evaluating Hotwire Insurance coverage to Different Choices

Navigating the labyrinth of automotive rental insurance coverage choices can really feel daunting. Understanding the nuances of Hotwire’s protection compared to different suppliers, together with conventional rental corporations and private journey insurance coverage, is essential for making an knowledgeable choice. This comparability clarifies the advantages and disadvantages of every, empowering vacationers to decide on probably the most appropriate safety for his or her wants.

Variations Between Hotwire Insurance coverage and Different Rental Firms

Hotwire’s insurance coverage typically presents a streamlined strategy, ceaselessly bundling protection with the rental. Conversely, conventional rental corporations sometimes provide a broader spectrum of choices, permitting for better customization of protection. This typically interprets into probably larger upfront prices for extra complete safety. Hotwire’s packages are ceaselessly easier, which could be useful for vacationers searching for a simple resolution.

Nevertheless, the extent of protection may be much less intensive. For example, a selected add-on for injury to the automobile’s inside may be accessible from a conventional rental firm however absent from Hotwire’s package deal. Rigorously scrutinize the wonderful print to totally perceive the scope of protection.

Comparability of Hotwire Insurance coverage to Private Journey Insurance coverage

Private journey insurance coverage ceaselessly supplies broader protection encompassing not simply automotive rental, but in addition potential medical emergencies, journey cancellations, and misplaced baggage. Hotwire’s insurance coverage, nonetheless, is confined to the rental automotive itself. A key consideration is whether or not the excellent safety of a private journey coverage outweighs the comfort of Hotwire’s bundled insurance coverage. For instance, if a traveler is planning a major journey with a number of locations, together with worldwide journey, a private journey insurance coverage coverage may be extra complete.

However, a traveler solely renting a automotive for a brief home journey may discover Hotwire’s bundled insurance coverage satisfactory.

Analyzing Credit score Card Journey Insurance coverage Protection

Many bank cards provide journey insurance coverage advantages. This generally is a handy and cost-effective choice, however it typically comes with limitations. These insurance policies ceaselessly have particular phrases and circumstances, such at the least spending requirement or a time-frame inside which the rental should happen. Understanding these phrases is important. For example, a traveler utilizing a bank card with journey insurance coverage may discover that the protection is insufficient for a selected kind of injury or accident.

This might necessitate a overview of the bank card’s phrases to find out whether or not the protection aligns with the traveler’s wants.

Significance of Studying the High quality Print

The satan is within the particulars, particularly with insurance coverage insurance policies. Rigorously scrutinize the exclusions, limitations, and particular phrases. Insurance coverage insurance policies typically have clauses that restrict protection for pre-existing circumstances or sure sorts of damages. For example, a coverage may exclude protection for damages brought on by reckless driving or pre-existing injury to the rental automotive. It’s vital to totally perceive these circumstances to keep away from potential points.

Comparability Desk of Insurance coverage Choices

| Insurance coverage Kind | Hotwire | Competitor Rental Firms | Private Journey Insurance coverage | Credit score Card Journey Insurance coverage |

|---|---|---|---|---|

| Protection Scope | Restricted to rental automobile | Variable, typically customizable | Broader, encompassing journey elements | Restricted, typically with spending necessities |

| Value | Usually bundled, probably decrease | Variable, typically larger upfront | Variable, is determined by coverage | Included with bank card, typically free |

| Customization | Restricted | Excessive | Excessive | Restricted |

| Exclusions | Verify wonderful print | Verify wonderful print | Verify wonderful print | Verify wonderful print |

Situational Concerns for Hotwire Insurance coverage

Navigating the complexities of automotive rental insurance coverage, particularly when using providers like Hotwire, calls for a nuanced understanding of particular person circumstances. A one-size-fits-all strategy to insurance coverage is commonly impractical; the optimum alternative hinges on the particular nuances of your journey plans and private danger tolerance. This part will illuminate numerous situations, offering readability on when Hotwire’s insurance coverage may be an acceptable choice, when separate insurance coverage may be extra prudent, and when the dearth of any protection might pose vital dangers.

When Hotwire Insurance coverage May Be a Worthwhile Choice

Hotwire’s insurance coverage package deal can show financially advantageous in sure conditions. For example, in case your funds is tight and also you’re searching for a cheap resolution, Hotwire’s protection may be a viable different to buying complete insurance coverage from a third-party supplier. This selection turns into significantly enticing for short-term leases, the place the added price of separate insurance coverage may outweigh the potential danger.

Moreover, for vacationers who’re already coated by a complete private insurance coverage coverage however want extra protection for particular rental situations, Hotwire’s insurance coverage can present a supplementary layer of safety.

When Separate Insurance coverage May Be Extra Advantageous

In distinction, buying separate insurance coverage could also be extra useful in situations demanding intensive protection. Should you anticipate high-risk driving conditions, corresponding to intensive freeway journey or driving in unfamiliar or difficult circumstances, extra protection by way of a devoted insurance coverage supplier may be essential. Additionally, take into account the rental period; longer leases typically necessitate a extra complete insurance coverage package deal. Equally, for drivers with a historical past of accidents or violations, or these renting in areas identified for larger incident charges, securing separate insurance coverage may be a sound monetary choice.

Conditions The place Having No Insurance coverage at All May Be Dangerous

The absence of any insurance coverage protection throughout a rental presents substantial dangers. Accidents, injury to the automobile, and even minor incidents like scratches or dents might result in vital monetary burdens. That is very true if the rental automotive is broken or concerned in an accident, the place the accountability and value of repairs may fall squarely on the renter’s shoulders.

Moreover, relying on the native legal guidelines and laws of the rental location, the absence of insurance coverage might have implications for authorized liabilities.

Significance of Understanding Private Insurance coverage Protection Earlier than Renting

Earlier than choosing Hotwire insurance coverage or another automotive rental protection, an intensive overview of your private insurance coverage coverage is important. Many private auto insurance coverage insurance policies present some degree of protection for damages or accidents incurred throughout a rental. Understanding the particular exclusions, limits, and circumstances of your current coverage will assist decide whether or not Hotwire’s insurance coverage is a mandatory addition or just an pointless duplication of protection.

For example, a coverage with complete protection could render Hotwire’s add-on redundant.

Eventualities and Suggestions

- Finances-conscious short-term leases: Hotwire’s insurance coverage may be a enough choice if the rental period is brief and the chance of injury or accident is comparatively low.

- Excessive-risk driving circumstances: Separate insurance coverage is beneficial for prolonged leases, freeway journey, or driving in difficult environments. That is important to cowl potential liabilities and intensive damages.

- Pre-existing accidents or violations: Separate insurance coverage is strongly suggested to mitigate the chance of upper premiums or protection limitations.

- Areas with excessive incident charges: In areas with the next focus of accidents, separate insurance coverage must be prioritized to safe satisfactory safety.

- Rental period exceeding a number of days: Separate insurance coverage can provide extra complete protection for prolonged leases.

- Complete private insurance coverage: Evaluate your current coverage’s protection for leases earlier than buying extra protection.

- Unexpected circumstances: Be ready for surprising conditions like accidents or injury. Insurance coverage protection supplies monetary safety in these conditions.

Understanding the Limitations of Hotwire Insurance coverage

Hotwire’s automotive rental insurance coverage, whereas seemingly handy, is not a common resolution. Understanding its limitations is essential for making knowledgeable choices and avoiding disagreeable surprises throughout your journey. A cautious evaluation of those restrictions ensures you are adequately ready for potential situations.

Pre-existing Circumstances and Harm, Is hotwire automotive rental insurance coverage price it

Hotwire insurance coverage insurance policies typically have exclusions for pre-existing circumstances on the automobile. This implies if the automotive already had injury or a mechanical subject earlier than you rented it, Hotwire’s protection won’t apply. Equally, pre-existing injury to the automobile, like a scratched bumper or a defective headlight, may fall outdoors the coverage’s scope. Thorough inspection of the automobile earlier than signing the rental settlement is paramount.

Hidden Prices and Charges

Past the acknowledged premium, Hotwire insurance coverage may embrace hidden charges or add-ons. These may very well be for particular providers, protection extensions, and even administration costs. Evaluate the wonderful print meticulously to determine any potential extra bills. Be cautious of marketed costs that appear too good to be true; a more in-depth look may reveal surprising costs.

Coverage Phrases and Circumstances

Rigorously reviewing the coverage’s phrases and circumstances is important. This doc particulars the specifics of the protection, together with exclusions, limitations, and the method for submitting claims. Unfamiliarity with these stipulations can result in issues when a declare arises. Understanding the precise parameters of the protection is essential to keep away from disappointment.

Examples of Non-Coated Damages

Hotwire’s insurance coverage won’t cowl damages stemming from sure occasions. For instance, injury brought on by intentional acts, corresponding to vandalism, won’t be coated. Likewise, injury from accidents brought on by intoxication or reckless driving may very well be excluded. Moreover, damages because of pure disasters, or injury ensuing from a pre-existing situation not reported earlier than the rental, are additionally potential exclusions.

Potential Limitations and Exclusions

| Potential Limitation/Exclusion | Description |

|---|---|

| Pre-existing Harm | Harm to the automobile current earlier than the rental, whether or not reported or not, is commonly excluded. |

| Intentional Acts | Damages brought on by deliberate actions (e.g., vandalism) are usually not coated. |

| Intoxication/Reckless Driving | Accidents brought on by the renter’s intoxication or reckless driving may very well be excluded. |

| Pure Disasters | Damages from pure disasters (e.g., storms, floods) won’t be coated. |

| Unreported Pre-existing Circumstances | Circumstances on the automobile that aren’t disclosed to Hotwire earlier than rental are sometimes excluded. |

| Unexpected Mechanical Failure | Protection for mechanical failure that was not instantly obvious or disclosed earlier than the rental will not be included. |

“Understanding the constraints of Hotwire insurance coverage is vital to avoiding monetary surprises. Totally reviewing the coverage, together with the phrases and circumstances, is paramount.”

Last Ideas

In conclusion, the worth of Hotwire automotive rental insurance coverage hinges on particular person circumstances. Weighing the bundled price in opposition to potential protection gaps and limitations is essential. Evaluating Hotwire’s insurance coverage with different choices—corresponding to separate rental insurance coverage or private journey insurance policies—is important. By understanding the specifics of every choice and the related prices, you’ll be able to confidently determine whether or not Hotwire’s insurance coverage aligns along with your wants and funds.

FAQ Insights: Is Hotwire Automobile Rental Insurance coverage Value It

Does Hotwire insurance coverage cowl pre-existing injury to the rental automotive?

No, Hotwire insurance coverage sometimes doesn’t cowl pre-existing injury. All the time examine the automobile completely upon pickup and doc any current injury.

What are the frequent limitations of Hotwire automotive rental insurance coverage?

Limitations typically embrace exclusions for particular sorts of injury, pre-existing circumstances, and sure driving behaviors. All the time overview the coverage’s phrases and circumstances completely.

How does Hotwire insurance coverage evaluate to a separate private journey insurance coverage coverage?

Hotwire’s insurance coverage is commonly bundled with the rental, whereas private journey insurance coverage supplies broader protection. Examine the particular coverages and limitations of every choice earlier than making a choice.

Can I exploit my bank card’s journey insurance coverage for Hotwire leases?

Probably, however overview your bank card’s journey insurance coverage coverage to grasp its applicability and protection for Hotwire leases. All the time verify protection particulars earlier than relying solely on this selection.