Knights of columbus long run care insurance coverage – Knights of Columbus long-term care insurance coverage affords a spread of plans designed to assist people put together for potential long-term care wants. Understanding the specifics of those insurance policies, together with protection particulars, prices, and eligibility necessities, is essential for making knowledgeable choices. This in-depth have a look at Knights of Columbus long-term care insurance coverage will equip you with the information you’ll want to navigate this essential side of monetary planning.

This evaluation explores numerous features of the Knights of Columbus long-term care insurance coverage merchandise, evaluating them to different choices in the marketplace. The detailed plan comparisons, protection specifics, and enrollment procedures will present a transparent image of the advantages and limitations of those plans.

Knights of Columbus Lengthy-Time period Care Insurance coverage Overview

Navigating the complexities of growing older typically entails contemplating long-term care insurance coverage choices. Knights of Columbus, a well-respected fraternal group, affords such protection to assist members and their households put together for potential future care wants. Understanding the specifics of those plans may help people make knowledgeable choices about their monetary safety.

Protection Particulars

Knights of Columbus long-term care insurance coverage merchandise present a spread of advantages designed to help policyholders in managing the prices related to long-term care. These insurance policies usually cowl bills associated to numerous care companies, from assisted dwelling to nursing house amenities. Nevertheless, the specifics of protection differ by plan, and it is important to rigorously evaluate the main points to find out the scope of advantages.

Varieties of Protection Supplied

The plans generally supply each day or month-to-month advantages, masking a portion of the prices of care. Completely different plans may have completely different limits on the whole quantity payable and the length of protection. Some plans might also supply particular advantages, corresponding to the choice for care at house, whereas others may solely cowl institutional care. It’s essential to rigorously study the precise provisions of every plan to find out its suitability for particular person wants.

Key Options and Advantages

A key profit of those plans is their potential to alleviate the monetary burden of long-term care. The plans typically embrace options corresponding to inflation safety, which adjusts advantages over time to account for rising care prices. Many additionally enable for a alternative of care settings. Moreover, the plans normally supply a ready interval earlier than advantages start, which wants cautious consideration when selecting a plan.

Eligibility Standards

Eligibility for Knights of Columbus long-term care insurance coverage typically depends upon elements corresponding to age, well being, and life-style. Typically, people should meet particular well being necessities to qualify for protection. It is important to seek the advice of the plan’s particular eligibility standards and the insurance coverage supplier for essentially the most correct and up-to-date info. The main points might differ throughout completely different plans, so thorough analysis is essential.

Plan Comparability Desk

| Plan Identify | Premium | Day by day Profit | Profit Interval |

|---|---|---|---|

| Plan A | $500 | $200 | 180 days |

| Plan B | $750 | $300 | twelve months |

| Plan C | $1000 | $500 | 730 days |

The desk above presents a simplified comparability of three pattern plans. Premium prices, each day advantages, and profit intervals can differ considerably based mostly on the precise plan chosen. All the time seek the advice of with a monetary advisor or the Knights of Columbus straight for customized recommendation and present pricing.

Protection Particulars and Advantages

Navigating the world of long-term care insurance coverage can really feel like navigating a maze. However don’t fret, we’re right here to interrupt down the specifics of Knights of Columbus insurance policies, making the advantages clear and comprehensible. Understanding what’s coated, and what’s not, is essential for making an knowledgeable determination. Understanding the intricacies of those insurance policies empowers you to decide on the plan that most closely fits your wants.

Particular Advantages Supplied

Knights of Columbus long-term care insurance coverage insurance policies usually supply a spread of advantages designed to help policyholders in managing the prices related to long-term care. These advantages differ relying on the precise plan chosen. Necessary concerns embrace the each day or month-to-month profit quantities, the utmost protection interval, and the varieties of care coated.

Bills Coated

The insurance policies typically cowl a big selection of bills associated to long-term care. These usually embrace the prices of expert nursing care, rehabilitation companies, assisted dwelling amenities, and private care companies. As well as, some insurance policies may cowl bills associated to house healthcare. The precise bills coated are detailed within the coverage paperwork.

Advantages in Completely different Situations

Think about a state of affairs the place a policyholder requires nursing house care as a consequence of a debilitating sickness. The coverage would supply a each day or month-to-month fee to cowl the prices of this care, relieving the monetary burden on the person and their household. Equally, if a policyholder wants assisted dwelling care to take care of their independence, the coverage would supply a fee to help with the bills of this care.

The coverage’s protection particulars will specify the exact quantity of protection and the precise care sorts it encompasses.

Limitations of Protection

Each coverage has limitations. These can embrace ready intervals earlier than advantages start, most profit intervals, and exclusions for sure pre-existing circumstances. Understanding these limitations is essential for assessing the coverage’s suitability. For instance, some insurance policies might exclude protection for care associated to psychological well being points. Policyholders ought to rigorously evaluate the coverage paperwork to completely perceive the restrictions.

Varieties of Care Coated

| Kind of Care | Protection Particulars |

|---|---|

| Nursing House Care | This usually covers the prices related to expert nursing care, together with 24-hour medical supervision, medicine administration, and different medical companies. The precise companies coated are Artikeld within the coverage particulars. |

| Assisted Residing Care | This typically covers the prices of assisted dwelling amenities, offering assist with each day actions like dressing, bathing, and meal preparation. The coverage particulars will specify the extent of help coated. |

| House Healthcare | Some insurance policies might cowl the prices of house healthcare companies, together with nursing, bodily remedy, and different supportive care offered within the policyholder’s house. This is usually a priceless profit for many who want to stay in their very own properties. |

Comparability with Different Lengthy-Time period Care Insurance coverage Choices

Navigating the long-term care insurance coverage panorama can really feel like looking for a needle in a haystack. With so many suppliers vying in your consideration, selecting the best coverage can really feel overwhelming. This part delves into how the Knights of Columbus coverage stacks up in opposition to different choices, highlighting key variations and similarities that will help you make an knowledgeable determination.

Key Variations and Similarities

The long-term care insurance coverage market affords a various array of plans, every with its personal strengths and weaknesses. Some insurance policies give attention to in depth advantages, whereas others prioritize affordability. Knights of Columbus plans, like many others, typically embrace options like inflation safety, which regulate advantages over time to account for rising dwelling prices. This ensures that the coverage’s worth stays in step with the evolving bills of care.

Conversely, some insurance policies might supply extra versatile fee choices or larger profit limits, however this typically comes with a better premium. The similarities lie within the basic purpose: offering monetary assist throughout a interval of needing long-term care. The important thing distinctions are within the specifics of protection, premiums, and administrative processes.

Premium Construction and Value Comparability

Understanding the monetary implications is essential. Premiums for long-term care insurance coverage can differ considerably based mostly on elements corresponding to age, well being, and desired protection degree. The Knights of Columbus usually affords a spread of premium choices tailor-made to completely different budgets. Straight evaluating the premiums with these from different suppliers is important. This comparability ought to think about not simply the preliminary premium but in addition any potential will increase over the coverage’s lifetime.

Profit Quantity and Protection Limits

The quantity of monetary help provided varies significantly between insurance policies. A key side is the each day or month-to-month profit quantity. Protection limits additionally play a vital function, figuring out the whole quantity the coverage pays over the complete length of care. The precise advantages and limits provided by the Knights of Columbus ought to be meticulously reviewed and in contrast with these of different suppliers to find out which possibility finest aligns together with your wants and price range.

This comparability must be made together with your private monetary scenario and anticipated long-term care wants.

Desk Evaluating Completely different Insurance coverage Suppliers

| Insurance coverage Supplier | Premium (Annual) | Profit Quantity (Day by day) | Protection Restrict (Months) |

|---|---|---|---|

| Knights of Columbus | $1,500 | $250 | 36 |

| Firm A | $2,000 | $300 | 48 |

| Firm B | $1,000 | $200 | 24 |

Be aware: This desk supplies a hypothetical comparability. Precise premiums, advantages, and protection limits will differ considerably based mostly on particular person circumstances and coverage specifics. Seek the advice of with a monetary advisor or insurance coverage skilled for customized suggestions. All the time confirm the accuracy of the data offered with the insurance coverage supplier straight.

Enrollment and Utility Course of

Able to safe your future with Knights of Columbus long-term care insurance coverage? Navigating the applying course of can really feel daunting, however understanding the steps concerned makes the entire expertise smoother. This information will break down the applying course of, from preliminary inquiries to ultimate submission, that will help you confidently embark on this necessary journey.

Utility Steps

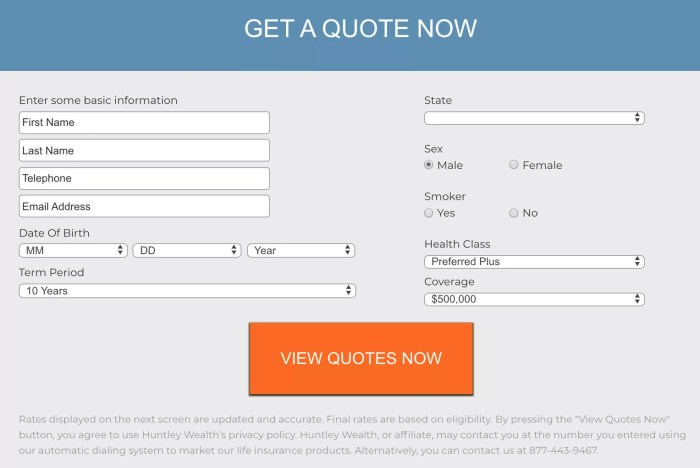

The appliance course of for Knights of Columbus long-term care insurance coverage usually entails a number of key steps. First, you may want to collect all the required documentation. This normally consists of private info, medical historical past, and monetary particulars. Then, you may full an software type, offering detailed details about your well being, life-style, and desires. Lastly, you may submit the finished software and supporting paperwork to the Knights of Columbus.

The method, whereas multi-faceted, is designed to make sure the insurance coverage aligns together with your particular person necessities and danger profile.

Required Documentation

Complete documentation is important for a clean software course of. The precise paperwork required can differ relying on the coverage kind and your particular person circumstances. Nevertheless, typically anticipated paperwork embrace proof of identification, corresponding to a driver’s license or passport. Medical data, together with particulars of any pre-existing circumstances, might also be requested. Monetary info, corresponding to earnings and belongings, is commonly obligatory for assessing eligibility and premium calculations.

It is essential to grasp the significance of offering correct and full info all through the method to make sure a profitable software.

Enrollment Interval and Deadlines

Enrollment intervals for long-term care insurance coverage typically differ, and it is important to concentrate on deadlines. These intervals are normally open for a selected timeframe, after which purposes might not be accepted. Some insurers supply steady enrollment, however it’s essential to test the precise phrases and circumstances of the Knights of Columbus coverage. Missed deadlines may end up in delayed protection and even the lack to enroll in any respect, so cautious planning is essential.

Incessantly Requested Questions (FAQ)

- What if I’ve a pre-existing situation? The Knights of Columbus, like many insurers, assess danger elements to find out protection. Offering full and correct details about your medical historical past is essential for a good analysis of your software. Whereas pre-existing circumstances may influence premiums or protection, they do not essentially preclude protection. It is important to grasp how these circumstances might have an effect on your coverage and to debate them with a Knights of Columbus consultant.

- How lengthy does the applying course of take? The processing time for long-term care insurance coverage purposes can differ relying on the insurer and the complexity of the applying. Elements just like the completeness of documentation and the provision of underwriting assets can influence processing occasions. Typically, it is advisable to permit ample time for the method.

- Can I modify my software after submission? Modifying your software after submission will be difficult. It is advisable to rigorously evaluate the applying earlier than submission and guarantee all info is correct and full. Any adjustments ought to be communicated promptly to the insurer, and the influence on the applying reviewed.

Claims Course of and Buyer Service

Navigating long-term care insurance coverage can really feel like a maze, particularly with regards to claims. However realizing the steps concerned and the accessible assist could make the method considerably smoother. Understanding the declare course of, from initiation to approval, and the customer support channels accessible is essential for policyholders.The Knights of Columbus long-term care insurance coverage goals to make the claims course of as easy as doable.

Clear communication and responsive customer support are key components in offering peace of thoughts throughout a doubtlessly difficult time. This part will Artikel the declare submitting process, the approval course of, and the varied avenues for policyholders to achieve out for help.

Declare Submitting Process

A well-defined declare submitting process is important for a clean course of. This entails offering the required documentation and making certain the declare is submitted precisely. Policyholders ought to rigorously evaluate the coverage paperwork for particular necessities and deadlines. Understanding the documentation wanted and the steps concerned can save priceless time and guarantee a faster declare approval.

Declare Approval Course of

The declare approval course of entails a collection of steps. The insurance coverage supplier will evaluate the submitted documentation to evaluate the validity and eligibility of the declare. This consists of verifying the policyholder’s situation and assembly the Artikeld standards within the coverage. A radical analysis course of ensures honest and well timed approvals. Policyholders can count on common updates relating to the declare standing.

Buyer Service Choices

Policyholders have a number of choices for customer support. This enables for flexibility and accessibility. These choices embrace telephone assist, e mail communication, and doubtlessly on-line portals. The assorted avenues for assist are designed to satisfy the precise wants and preferences of every policyholder. Fast entry to assist is important throughout a delicate time.

Contact Info and Declare Procedures, Knights of columbus long run care insurance coverage

| Contact Info | Process |

|---|---|

| Cellphone Quantity: 1-800-555-1212 | To provoke a declare, policyholders ought to name this quantity, offering their coverage quantity and particulars of the required care. They need to count on to be guided by the declare submitting course of. |

| E mail Handle: claims@kofcinsurance.com | For inquiries relating to the declare approval course of, policyholders can ship an e mail detailing their scenario and the precise query. Anticipate a response inside an affordable timeframe. |

Coverage Concerns and Prices: Knights Of Columbus Lengthy Time period Care Insurance coverage

Navigating the world of long-term care insurance coverage can really feel like wading by murky waters. Understanding the coverage’s tremendous print, prices, and potential pitfalls is essential earlier than signing on the dotted line. This part will dissect the important thing concerns that will help you make an knowledgeable determination.

Coverage Exclusions and Limitations

Lengthy-term care insurance policies, like all insurance coverage product, have exclusions and limitations. These clauses outline conditions the place protection won’t apply. Understanding these beforehand prevents disagreeable surprises down the street.

- Pre-existing circumstances: Many insurance policies exclude protection for circumstances that existed earlier than the coverage was bought. This implies if you have already got a power sickness, it won’t be coated beneath the coverage. Rigorously evaluate the coverage’s definition of pre-existing circumstances and guarantee it aligns together with your well being standing.

- Particular care sorts: Some insurance policies might not cowl all varieties of care, corresponding to sure therapies or specialised medical tools. The coverage’s specifics relating to coated care sorts ought to be totally examined. For instance, a coverage won’t cowl the price of a non-public caregiver, whereas one other may cowl a spread of house care choices.

- Care settings: The coverage may outline the settings through which care is roofed. A coverage may restrict protection to assisted dwelling amenities, excluding protection for in-home care or nursing properties.

- Cut-off dates: Some insurance policies have limitations on the size of protection. As an example, the coverage may solely present protection for a most variety of years or days of care.

Prices Related to the Insurance coverage

The price of long-term care insurance coverage is a big issue to contemplate. Premiums, deductibles, and different related charges will differ based mostly on a number of elements. Think about the coverage’s monetary implications earlier than committing.

- Premiums: These are the common funds you make to take care of your protection. Premiums are influenced by your age, well being, and the extent of protection chosen. A youthful, more healthy particular person will doubtless pay lower than an older, extra weak individual. Premiums ought to be in contrast in opposition to the potential payout to make sure worth.

- Deductibles: A deductible is the quantity it’s a must to pay out-of-pocket earlier than the insurance coverage firm begins to pay. This quantity is usually a substantial monetary burden for those who require long-term care companies.

- Co-pays and co-insurance: These are further prices you might incur. The share you pay varies significantly between insurance policies.

Influence of Inflation on Lengthy-Time period Care Prices

The price of long-term care is rising at a quicker fee than the general inflation fee. This implies the bills associated to care will doubtless enhance over time. The long-term care coverage ought to handle this challenge to guard in opposition to a future shortfall in funds.

The rising price of long-term care is a big concern, requiring a coverage to be adjusted to account for inflation.

The instance of a rising aged inhabitants mixed with the growing complexity of care companies clearly demonstrates the rising prices. The coverage ought to embrace a cost-of-living adjustment (COLA) or different provisions to account for the inflation-related will increase. This ensures the protection stays related and ample as care wants evolve.

Coverage Phrases and Situations

Understanding the coverage’s phrases and circumstances is essential. These particulars present a complete Artikel of the coverage’s specifics, together with the tasks of each the policyholder and the insurance coverage firm. The tremendous print Artikels the foundations of the sport.

- Coverage length: The size of time the coverage stays energetic. An extended length coverage may help to cowl longer intervals of care.

- Renewal choices: The power to resume the coverage or the circumstances for renewal. Insurance policies may need clauses that restrict renewal, so it’s essential to test these provisions.

- Declare procedures: The steps concerned in submitting a declare. Understanding the declare course of will ease any future points or delays.

- Coverage amendments: The circumstances beneath which the coverage will be modified or modified.

Illustrative Examples of Protection

Planning for long-term care can really feel like navigating a maze, however understanding the Knights of Columbus coverage could make it rather less daunting. This part will discover how the protection works in real-life eventualities, highlighting each the advantages and the restrictions. We’ll see how completely different care wants and coverage choices influence prices, providing sensible insights that will help you make knowledgeable choices.

Situations Illustrating Advantages

This part particulars conditions the place the Knights of Columbus Lengthy-Time period Care Insurance coverage can be advantageous, exhibiting the way it can present monetary assist throughout a difficult time.

- Situation 1: Progressive Mobility Points: Think about a 65-year-old policyholder, energetic and engaged in hobbies. A gradual onset of arthritis and mobility points necessitates growing help with each day duties, ultimately requiring a transfer to assisted dwelling. The coverage would cowl a portion of the rising prices for assisted dwelling, doubtlessly easing the monetary burden on the person and their household.

- Situation 2: Power Sickness Requiring House Healthcare: A 72-year-old policyholder with a historical past of coronary heart circumstances experiences a debilitating stroke. Whereas recovering, they want around-the-clock house healthcare companies for a number of months. The coverage would cowl a good portion of those prices, stopping the person and household from shouldering the complete monetary weight of the caregiving scenario.

- Situation 3: Dementia Resulting in Expert Nursing Care: A 78-year-old policyholder recognized with Alzheimer’s illness requires more and more specialised care. Because the illness progresses, expert nursing care turns into obligatory in a reminiscence care facility. The coverage would supply monetary assist to cowl the prices of this specialised care, making certain the policyholder’s consolation and dignity.

Coverage Limitations and Exclusions

Understanding what the policydoesn’t* cowl is equally necessary as realizing what it does. Listed here are some cases the place the coverage might not present protection.

- Situation 4: Beauty Procedures: A policyholder requires bodily remedy to regain power after a fall. Whereas the coverage covers remedy to revive performance, it typically will not cowl beauty procedures unrelated to restoring performance.

- Situation 5: Pre-existing Situations: If a policyholder develops a severe situation earlier than acquiring the coverage, protection could also be restricted or excluded. A policyholder who has a historical past of a debilitating sickness might discover that the insurance coverage would not cowl these pre-existing circumstances or might require an extended ready interval for protection.

- Situation 6: Care Supplied by Unlicensed Caregivers: The coverage might not cowl care offered by unqualified people who aren’t licensed or licensed within the area. Care should meet particular requirements set by the coverage for it to be coated.

Influence of Coverage Choices on Prices

The price of long-term care insurance coverage can differ based mostly on the policyholder’s age, well being, and the chosen protection choices.

| Coverage Possibility | Description | Influence on Value |

|---|---|---|

| Primary Protection | Covers fundamental each day dwelling actions. | Typically decrease premiums. |

| Complete Protection | Covers a wider vary of care wants, together with expert nursing and assisted dwelling. | Increased premiums however better monetary safety. |

| Enhanced Protection | Consists of further advantages corresponding to respite care or long-term care companies for a partner. | Highest premiums however broadest safety. |

Completely different coverage choices have a direct influence on the premium prices. People ought to weigh the extent of their anticipated care wants in opposition to the price of completely different coverage choices to make a financially sound alternative.

Final Recap

In conclusion, Knights of Columbus long-term care insurance coverage presents a viable possibility for people in search of safety in opposition to long-term care bills. Nevertheless, cautious consideration of the precise coverage phrases, premiums, and protection limitations is important. By understanding the advantages and potential drawbacks, you may make an knowledgeable determination about whether or not this kind of insurance coverage aligns together with your monetary wants and long-term care objectives.

FAQ

What are the widespread exclusions in Knights of Columbus long-term care insurance coverage insurance policies?

Coverage exclusions typically embrace pre-existing circumstances, sure varieties of care not assembly particular standards, and circumstances arising from intentional self-harm or substance abuse.

What’s the typical declare approval course of for Knights of Columbus long-term care insurance coverage?

The declare course of usually entails submitting required documentation, present process a evaluate by the insurance coverage firm, and receiving notification of the declare’s standing. Particular timelines might differ relying on the circumstances.

How does Knights of Columbus LTC insurance coverage evaluate to different suppliers by way of premiums?

Premiums can differ considerably relying on the precise plan chosen and the person’s well being profile. An in depth comparability desk is important to judge the cost-effectiveness of Knights of Columbus LTC insurance coverage relative to different choices.

Are there any particular concerns for people with pre-existing well being circumstances when making use of for Knights of Columbus long-term care insurance coverage?

Eligibility standards and protection limitations might apply to people with pre-existing circumstances. Evaluate the coverage particulars rigorously and search clarification from Knights of Columbus representatives.